In this article, we'll take a look at the numbers and compare the value appreciation of houses, townhouses, and apartments in Auckland over the past two decades.

Houses vs. Townhouses vs. Apartments: A Look at the Numbers

When it comes to investing in property, the type of property you choose can make a big difference in your returns. Here’s a look at how houses, townhouses, and apartments have performed in Auckland over the past two decades:

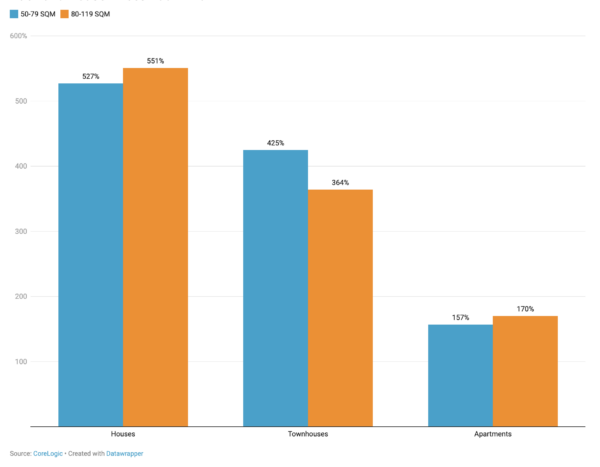

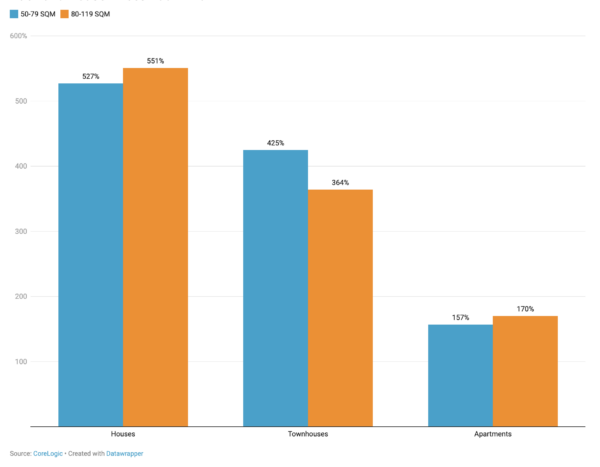

Houses: Between 2001 and 2021 in Auckland, two-bedroom houses increased in value by 551%. This is a significant increase and reflects the desirability of houses as a property investment.

Townhouses: Over the same period, two-bedroom townhouses increased in value by 364%. While not as high as houses, this is still a respectable increase and makes townhouses a viable investment option.

Apartments: Two-bedroom apartments increased in value by 170% during the same time period. While this may seem like a low return compared to houses and townhouses, it’s important to note that apartments are typically cheaper to purchase than houses or townhouses, which can make them a more affordable entry point for property investors.

Auckland House Prices 2001 – 2021

Considerations for each property type

So, which type of property is the best investment for you? The answer depends on your goals and preferences. Let’s take a closer look at the advantages of each type of property.

Houses

Houses are typically the most sought-after type of property. They offer a lot of space and privacy, making them an ideal choice for families or anyone who wants a large living space. They also tend to be located in desirable neighbourhoods with good schools and amenities, which can contribute to their value.

One of the advantages of houses is the potential to develop and subdivide the land in the future, which can increase the property’s value and provide additional income. However, this requires a significant investment of time and money, and there are also zoning and regulatory restrictions to consider.

While houses may see the most significant increase in value, they also require the most maintenance and upkeep. As the owner, you will be responsible for all repairs and maintenance, which can be time-consuming and costly. Additionally, the high upfront cost of a house can make it challenging for first-time investors to enter the property market.

Townhouses

Townhouses are an excellent investment option for those who want more space than an apartment but don’t want to pay the high price tag of a house. They offer a good compromise between the two, providing a smaller living space with lower maintenance costs.

One of the main advantages of townhouses is that they offer a better marginal yield than houses. This is because townhouses have a lower purchase price and can often be rented out for a similar price to a house, resulting in a higher rental yield

Apartments

Apartments are an excellent choice for investors who want a low-maintenance property with potentially lower entry costs. They require little upkeep, and the owner is typically not responsible for any repairs or maintenance. This makes them an ideal choice for investors who want to rent out their property.

However, apartments often come with body corporate fees, which can eat into the rental income and hurt the cash flow. These fees cover the maintenance and upkeep of shared areas such as lifts, pools, and gyms, and can sometimes be expensive.

Choosing the Right Property to Invest In

When it comes to investing in properties, there is no one-size-fits-all solution. The right property for you will depend on your investment goals, budget, and personal preferences. Here are some factors to consider when choosing the right property to invest in:

Location: Location is a key factor in determining the value of a property. Look for properties in areas with good schools, amenities, and transport links. Properties that are close to public transport, shops, and schools are more likely to appreciate in value over time.

Rental yield: The rental yield is the annual income generated by a property as a percentage of its value. Look for properties with a high rental yield, as this indicates that the property is generating good income.

Capital growth potential: Capital growth is the increase in the value of a property over time. Look for properties in areas that are expected to experience strong capital growth, such as areas undergoing regeneration or gentrification.

Maintenance costs: Consider the cost of maintaining the property. Newer properties are likely to require less maintenance, while older properties may require significant repairs and renovations.

Investment strategy: Determine your investment strategy. Are you looking for a short-term or long-term investment? Do you want to buy and hold the property or flip it for a quick profit?

Property type: Consider the type of property you want to invest in. Are you looking for a house, townhouse, or apartment? Each property type has its advantages and disadvantages, so choose the one that best suits your investment goals.

Your budget: Determine your budget for the investment property. Consider all the costs associated with purchasing and maintaining the property, including mortgage payments, insurance, taxes, and repairs.

Conclusion

Investing in property can be a great way to build wealth and secure your financial future. When it comes to choosing the right property type, there are several factors to consider, including location, price, and potential for appreciation. While houses have historically shown the highest appreciation rates in Auckland, townhouses have also proven to be a strong investment option, with steady growth rates and the added benefit of low maintenance costs.

Ultimately, the decision to invest in property should be based on your individual financial goals and circumstances. Whether you choose to invest in a house, townhouse, or apartment, it’s important to do your research, work with a knowledgeable financial advisor, and carefully consider all your options before making any investment decisions. With the right strategy and approach, investing in property can be a smart and lucrative choice for your financial future.

For a no obligation discussion to see how we can help you on the path to wealth, please contact us.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.