We explore the various factors contributing to the current cash flow dilemma for property investors and discuss when the market might tilt in their favour.

Insights by

Property investment has long been considered a reliable avenue for building wealth. However, recent challenges have left investors grappling with the question of when they can expect to achieve positive cash flow once again. In this article, we’ll explore the various factors contributing to the current cash flow dilemma for property investors and discuss when the market might tilt in their favour.

The Rising Costs of Property Investment

To understand the predicament property investors find themselves in today, it’s essential to examine the factors driving up the costs associated with property ownership.

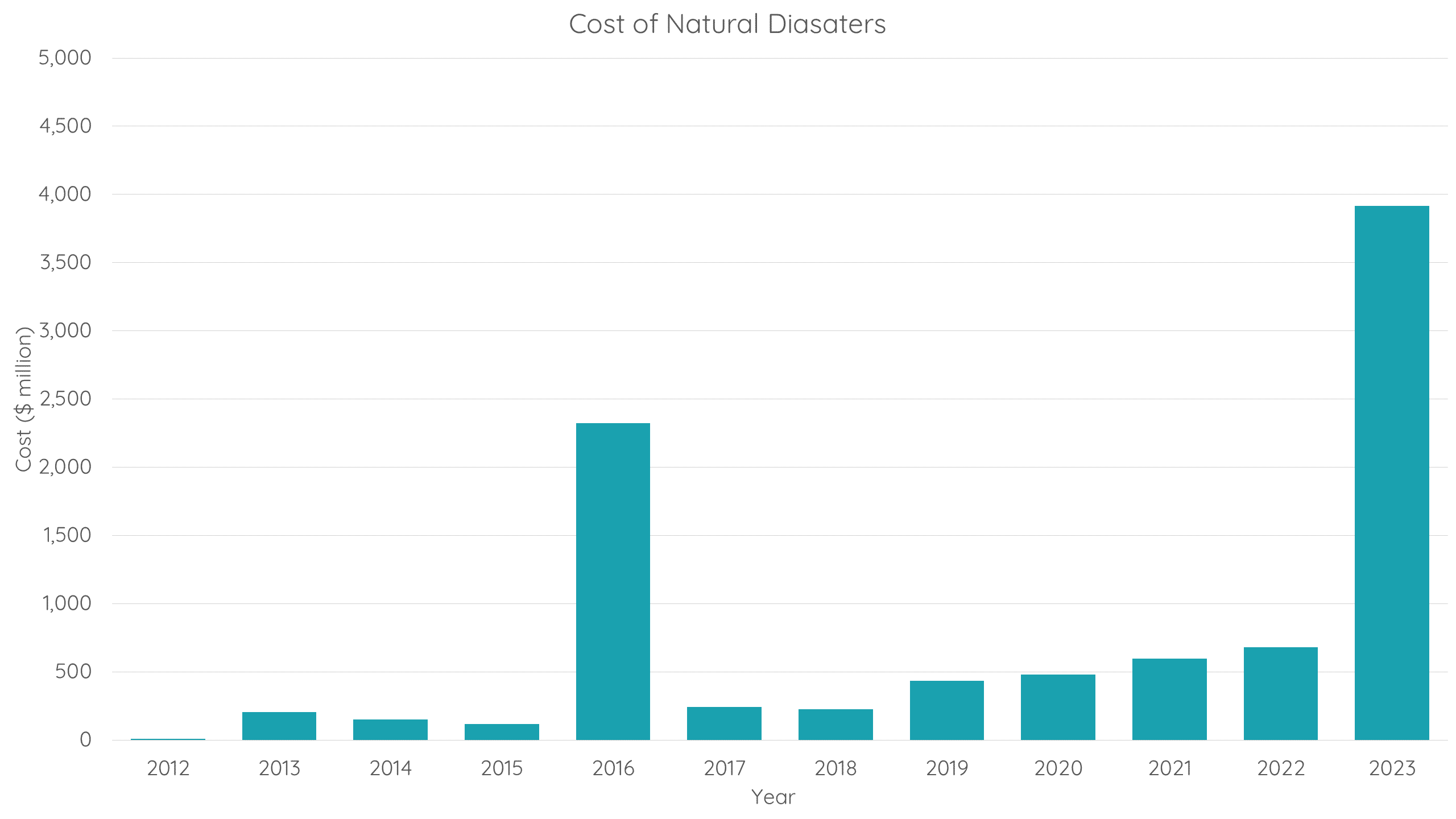

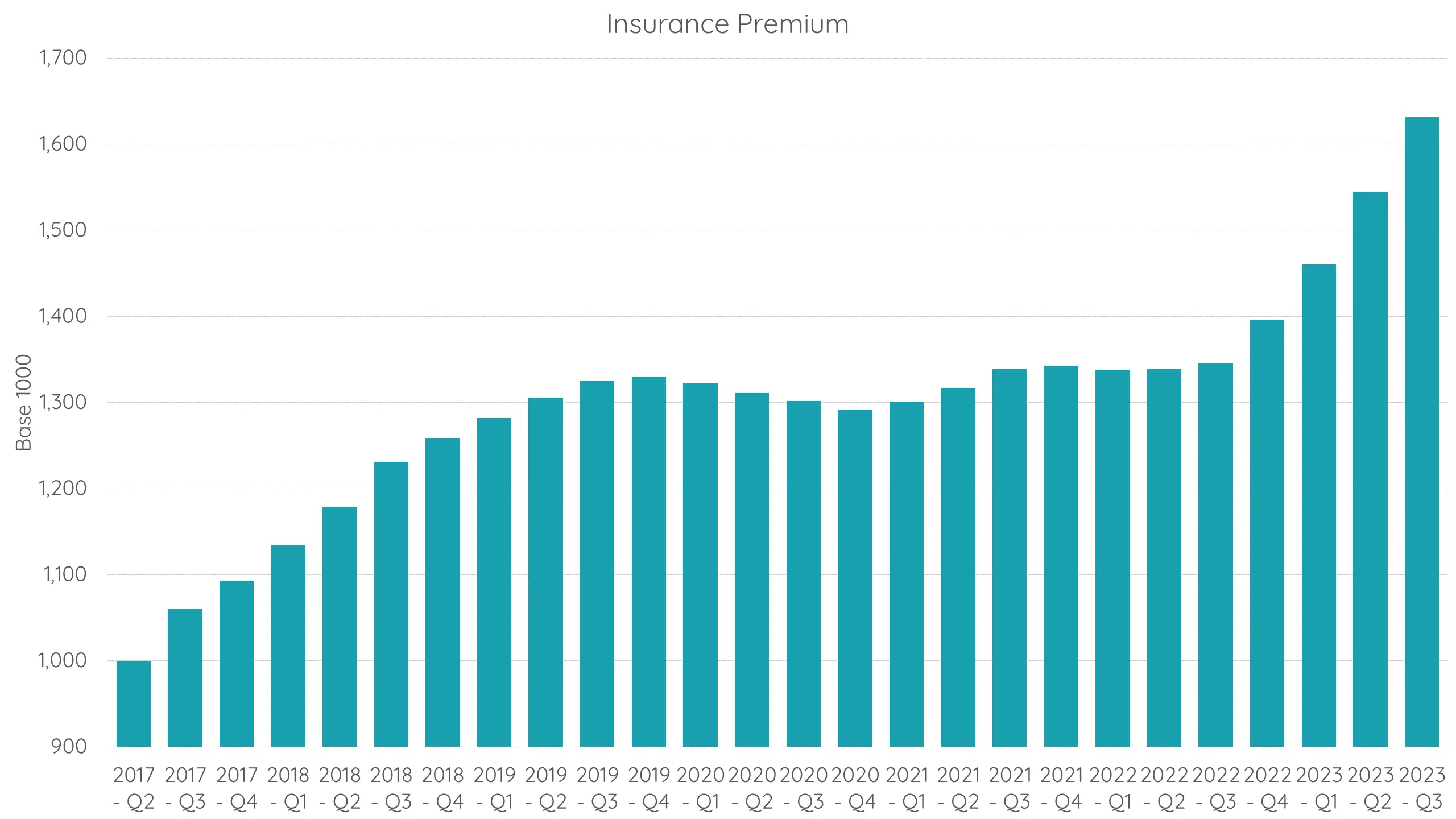

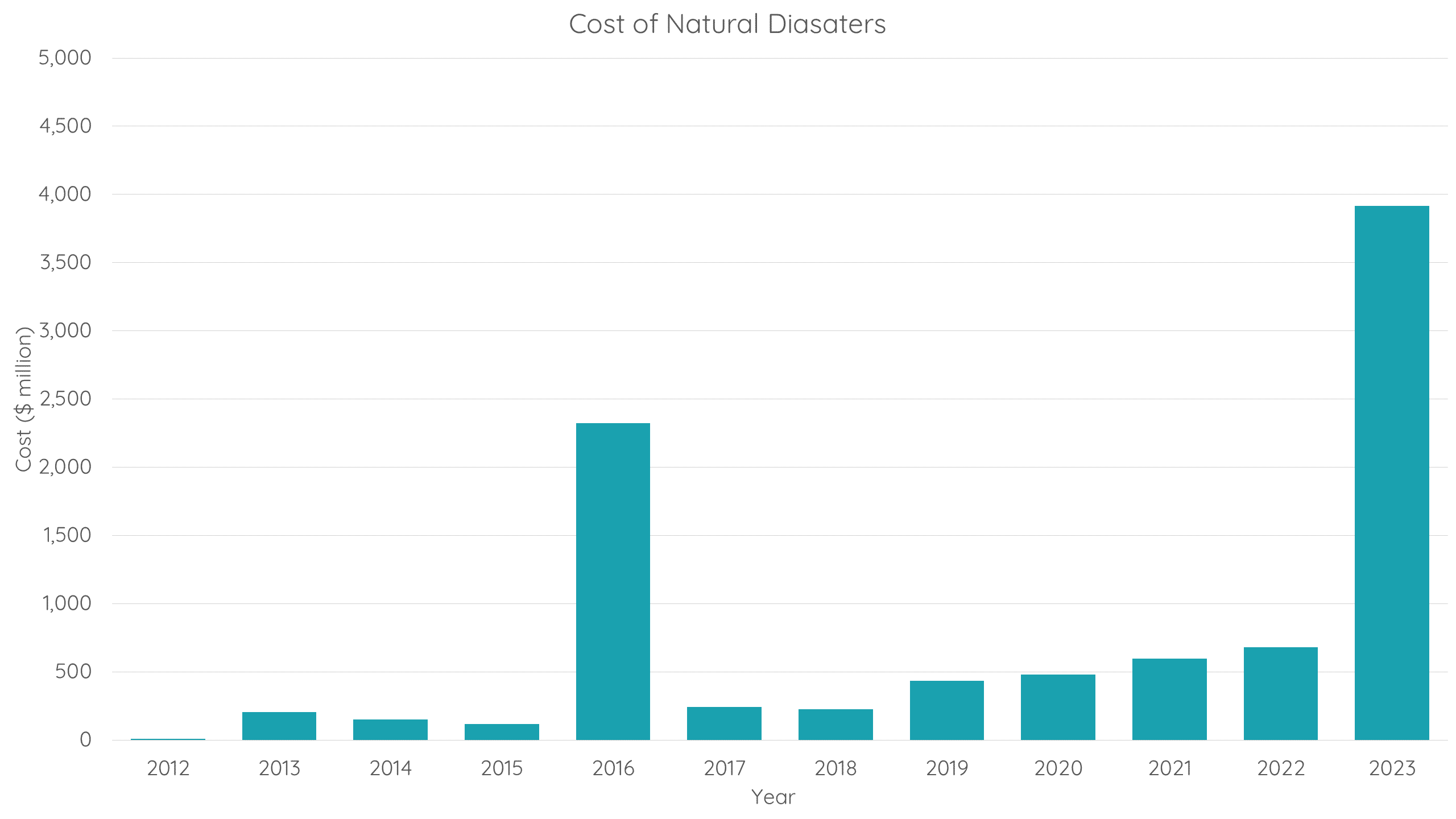

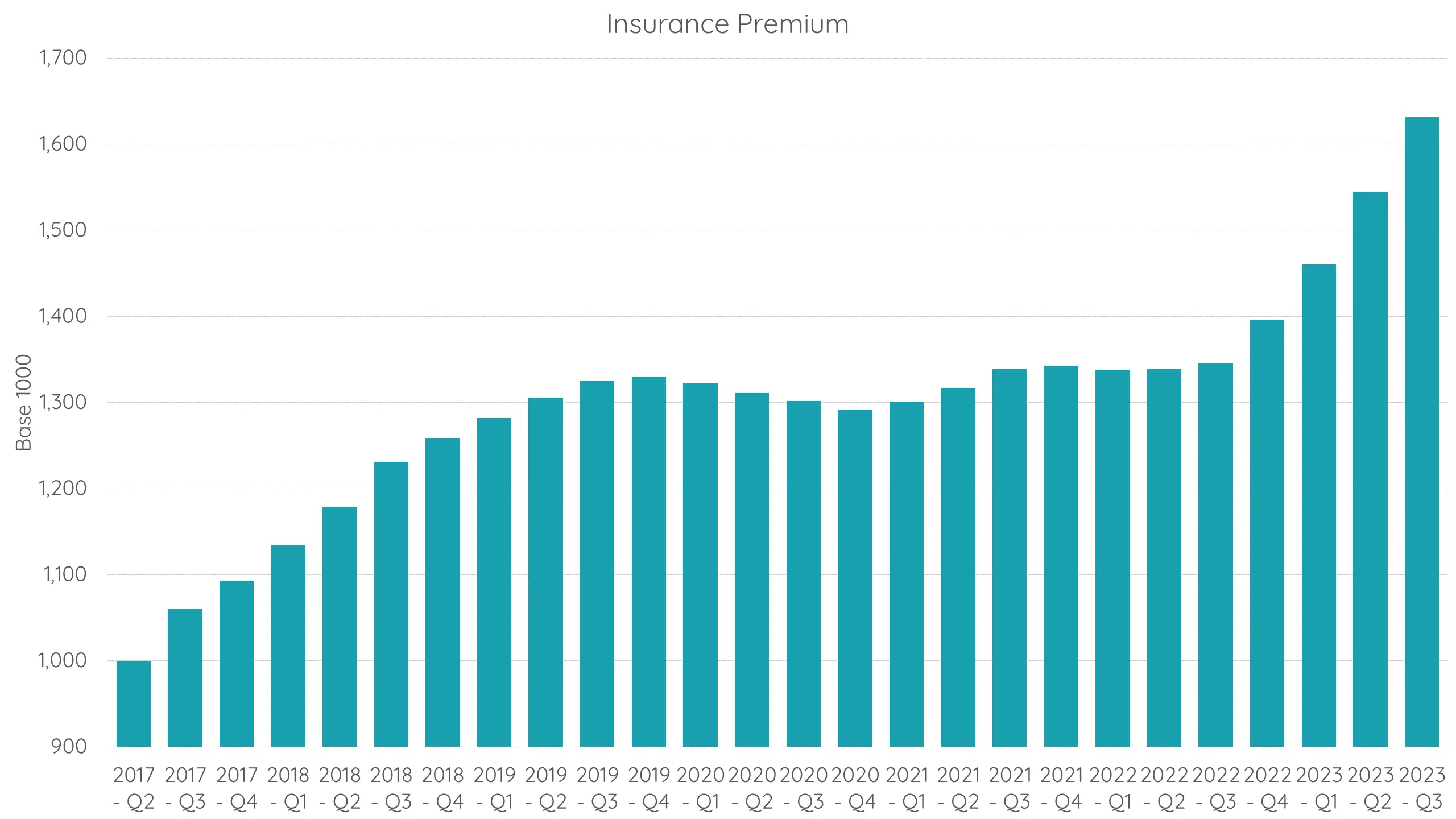

Insurance Costs: In recent years, insurance premiums have been on the rise due to the increasing incidence of natural disasters and rising construction costs. This has translated into higher expenses for property owners.

Rates: Council rates, another significant expense for property owners, have also experienced substantial increases, driven by inflation and higher interest rates, which impact councils’ borrowing costs.

Home Maintenance: Routine maintenance and upkeep costs have also been creeping up, adding to the overall financial burden for property investors.

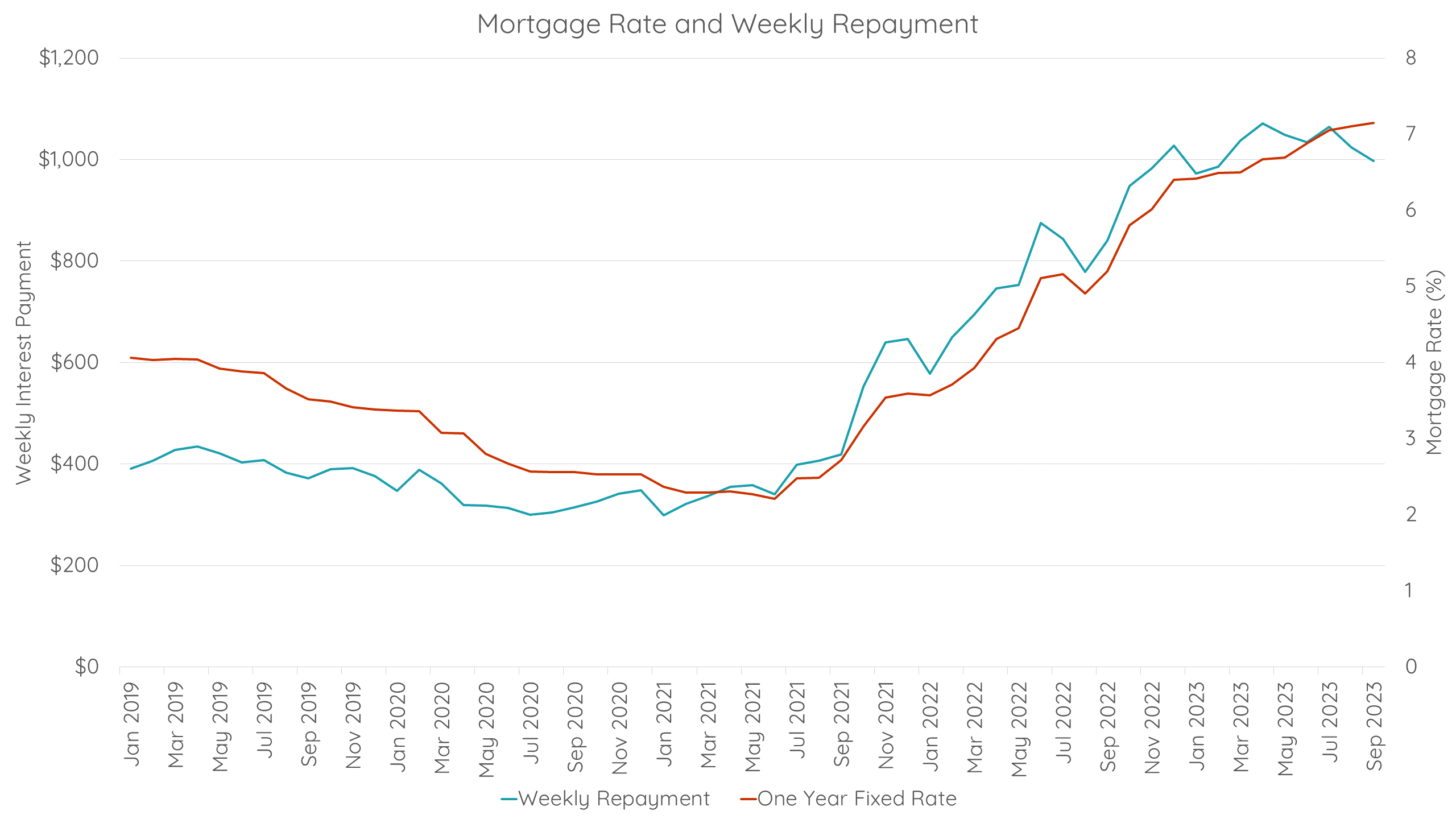

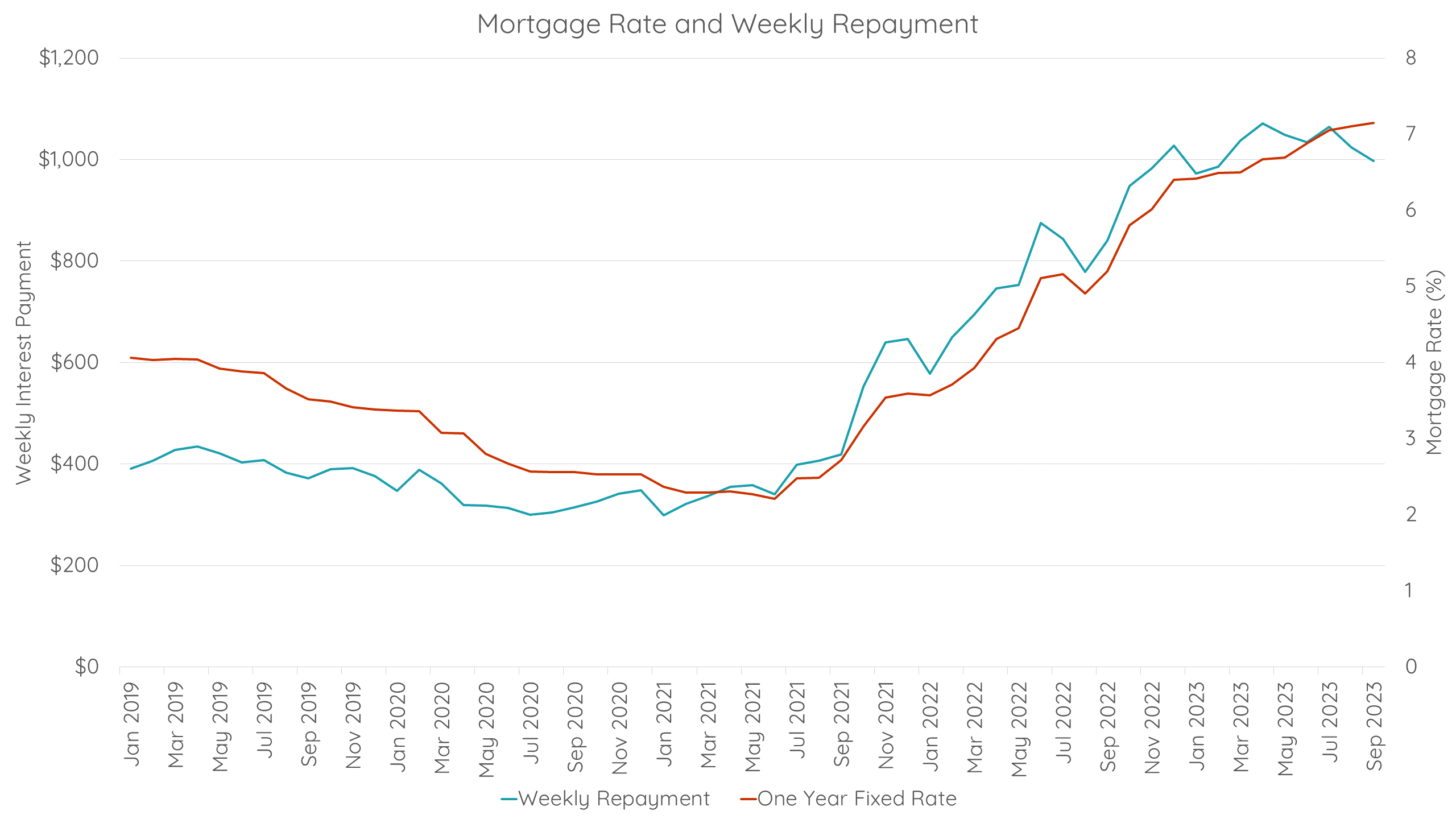

Interest Payments: Of all the costs, interest payments on mortgages are the most significant for property investors. Unfortunately, this cost has been skyrocketing as interest rates have risen sharply over the past couple of years.

The Impact of Interest Rate Increases

Interest rate increases have had a profound impact on property investors’ cash flow. Retail mortgage rates, which stood at a mere 2.2% in mid-2021, have surged to over 7% today. This rapid escalation in rates has caused investors’ weekly mortgage repayments to double in just two years for properties purchased during that period.

Below illustrates the stark difference in weekly repayments for an investor who entered the market in mid-2021. As rates climbed, the financial strain on property investors grew significantly.

When Will Properties Be Cashflow Positive Again?

To determine when property investors can expect to regain positive cash flow, it’s crucial to assess the trajectory of interest rates. While other costs like insurance premiums and rates are unlikely to decrease, interest costs are the primary variable.

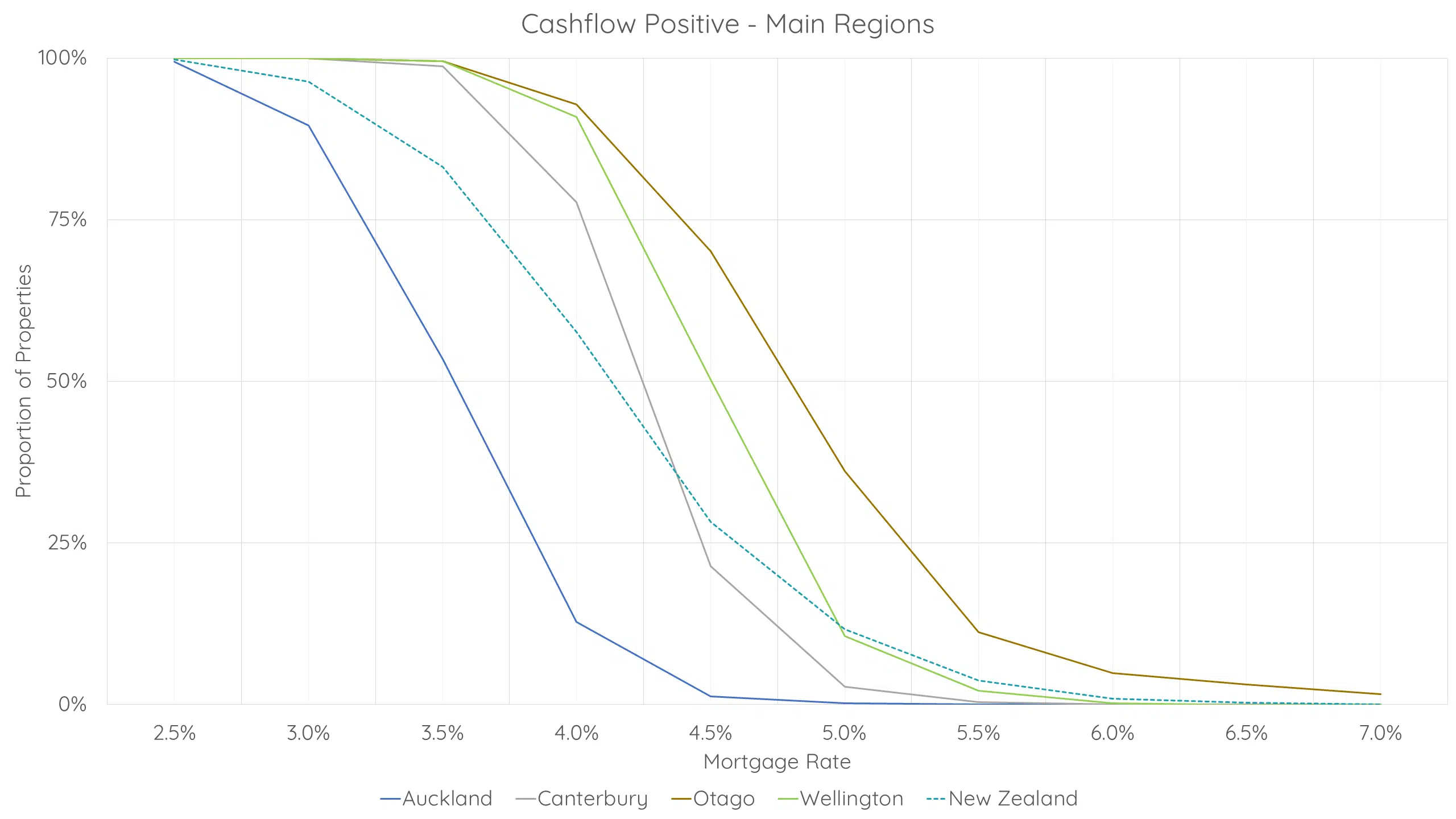

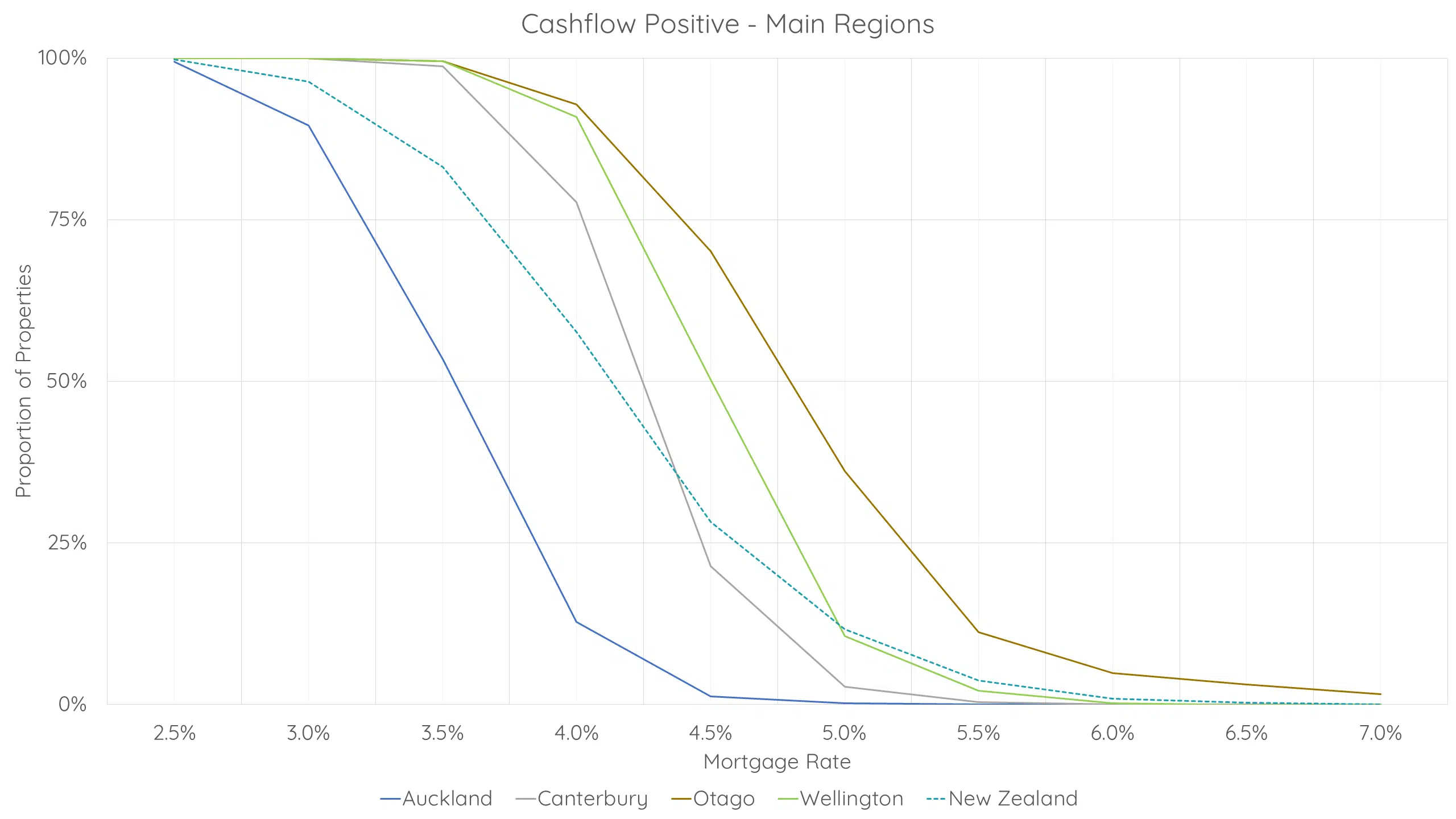

Figure 3 shows the historical trend of mortgage rates, and Figure 6 demonstrates the proportion of properties that are cashflow positive at various interest rate levels.

At a 2.5% mortgage rate, more than 90% of the properties investigated were cashflow positive, suggesting that investors were comfortably covering their expenses. However, as rates climbed to today’s 7%, over 90% of the same properties became cashflow negative, indicating that investors now face deficits and must rely on capital gains to remain in the market.

Predicting the Future of Interest Rates

The key question for property investors is when interest rates will decline, potentially allowing them to regain positive cash flow. While no one can predict interest rates with absolute certainty, it’s worth noting that interest rate cycles tend to move in five to eight-year patterns, with periods of ascent followed by descent.

Currently, there are signs that interest rates may have reached their peak. Wholesale cost of funds has shown some decline, though banks have maintained higher interest rates to preserve their margins. However, over the long term, it’s reasonable to anticipate interest rates returning to more affordable levels.

For a no obligation discussion to see how we can help you on the path to wealth, please contact us.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.