Our quarterly update from the Lighthouse team

Quarterly Update

Despite the most recent GDP figures indicating a small rebound in the New Zealand economy (1.7%) for the June quarter, headwinds from war, inflation, and supply-side disruptions from the pandemic continued to impact markets this quarter. After an initial rally from equities in July and August, bonds suffered their largest losses since 1842 as central banks stepped up the tightening of monetary policy and communicated that rates might need to be higher for longer to dampen inflation back to target levels.

A particular feature over the quarter was the extreme moves in currency markets with the US dollar approaching record highs on its trade-weighted basis. In comparison, the New Zealand dollar fell around 8% over the quarter, which helped cushion returns on overseas assets held on an unhedged basis. Furthermore, the UK pound fell around 10% to record lows against the US dollar following the release of a budget seen by the market as being unstable.

By quarter-end, stocks were solidly in bear-market territory (once again) and bond yields—which move in the opposite direction of prices—were at their highest levels in years. As in our previous update, the question still remains whether markets have reached the bottom and if central banks will need to take further action to fight inflation.

On the bright side, historical market trends suggest downturns similar to this year implies much better value today and as such, opportunity for greater returns over the medium to longer term. In addition, cash returns on various asset classes are now back to levels last enjoyed in pre-GFC days. For example, returns on global and NZ government bonds are now around 4-5%, compared to under 1% only a year ago.

Over the past 100 years large gains have followed large falls

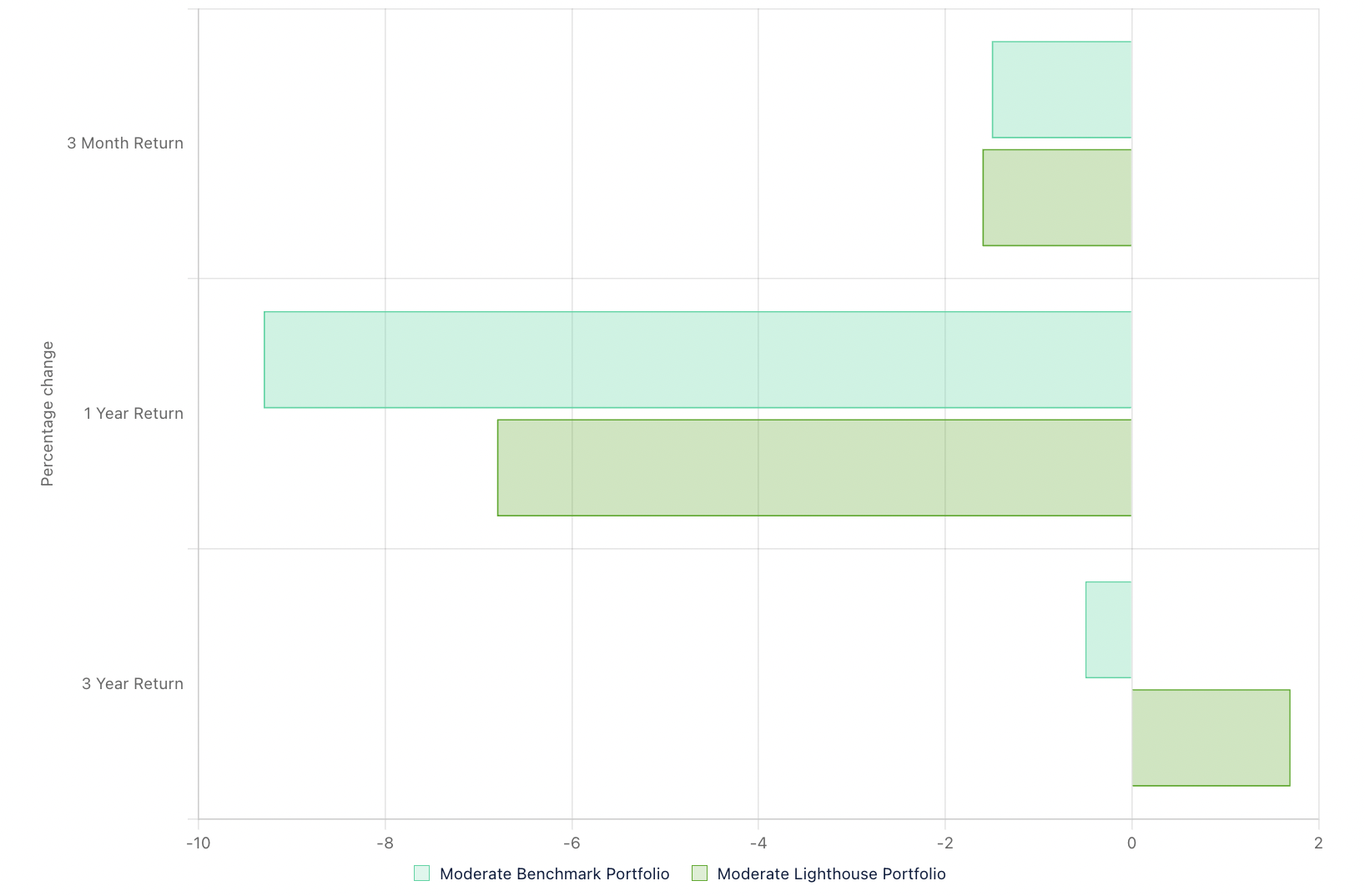

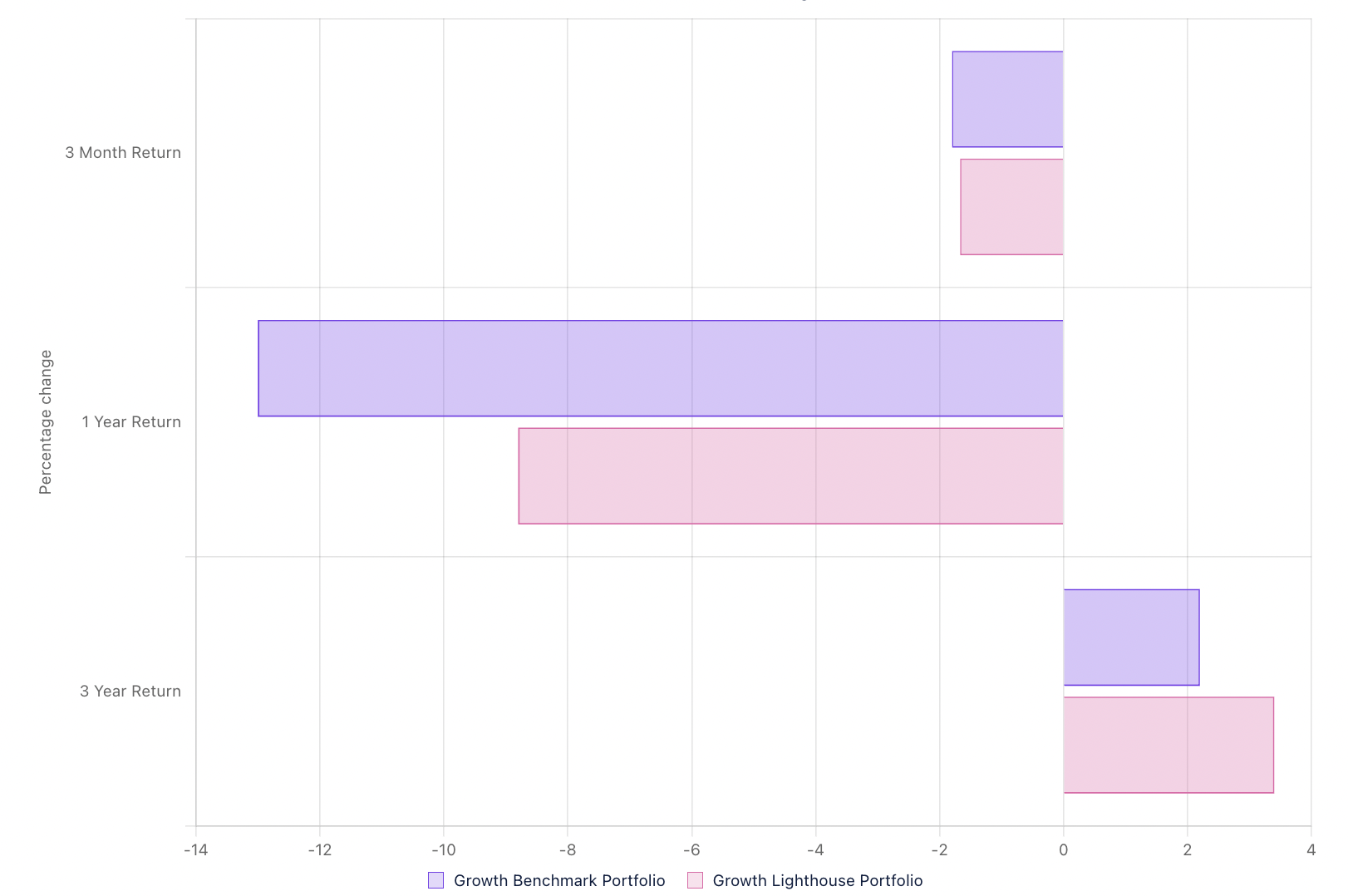

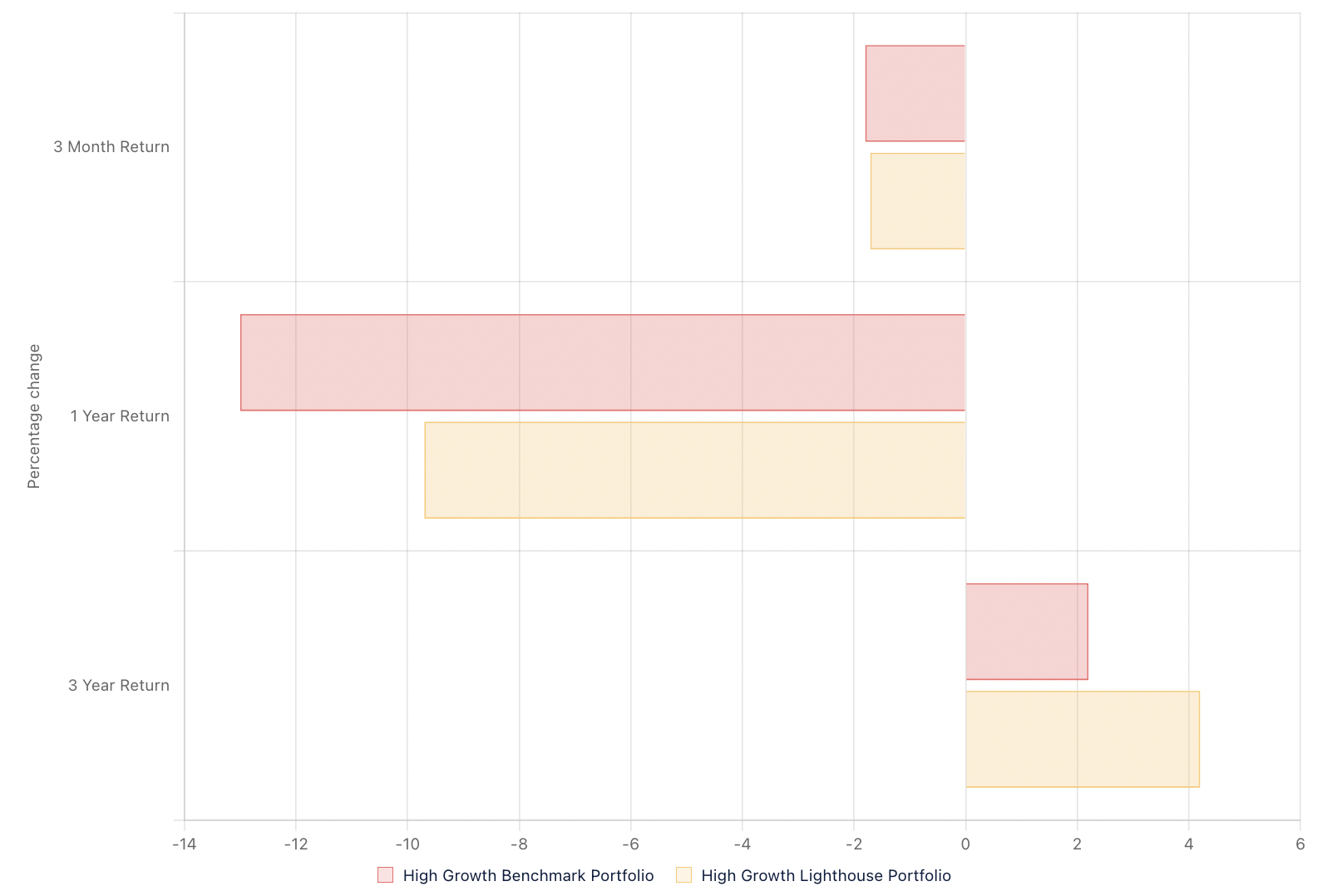

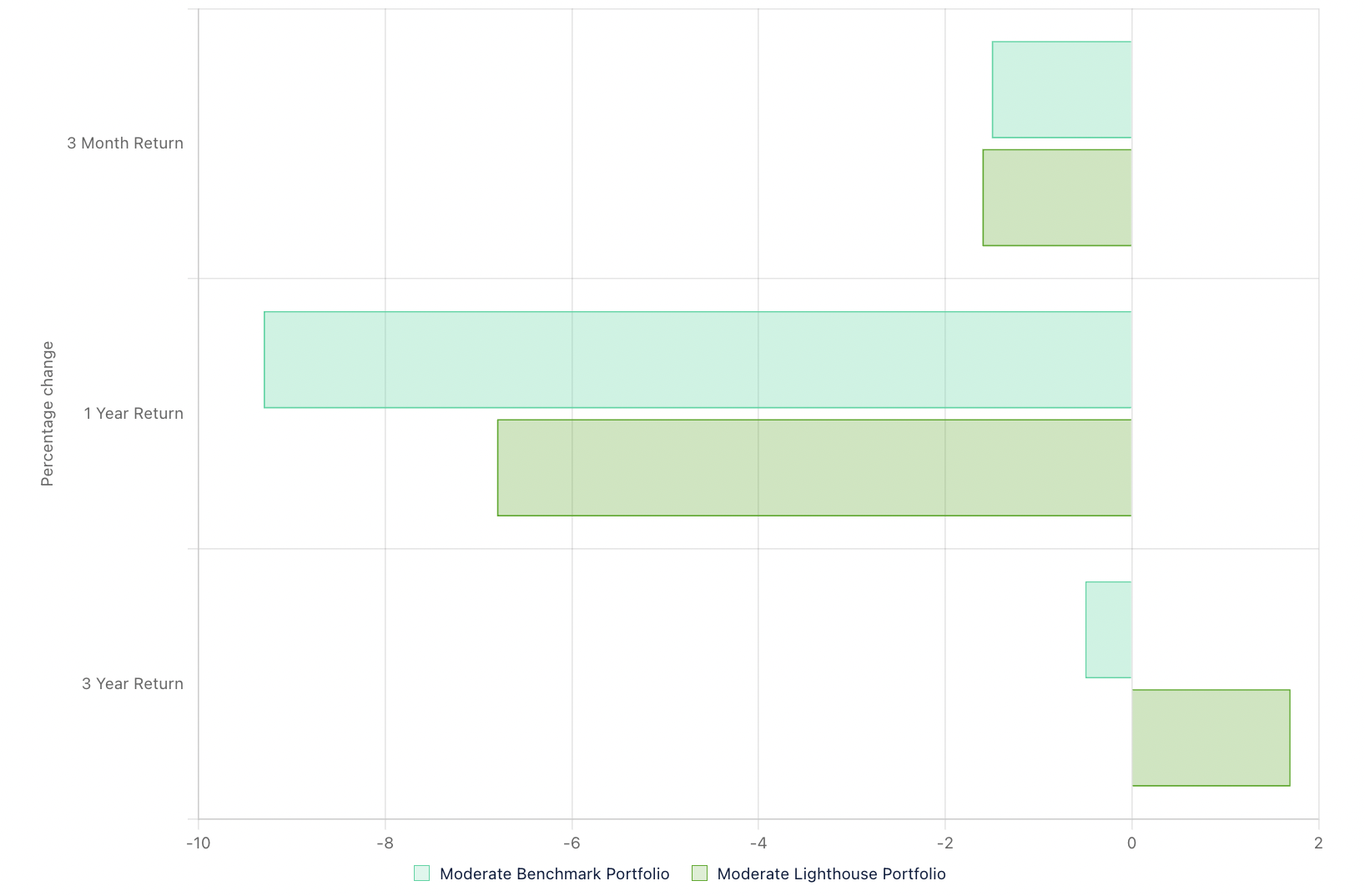

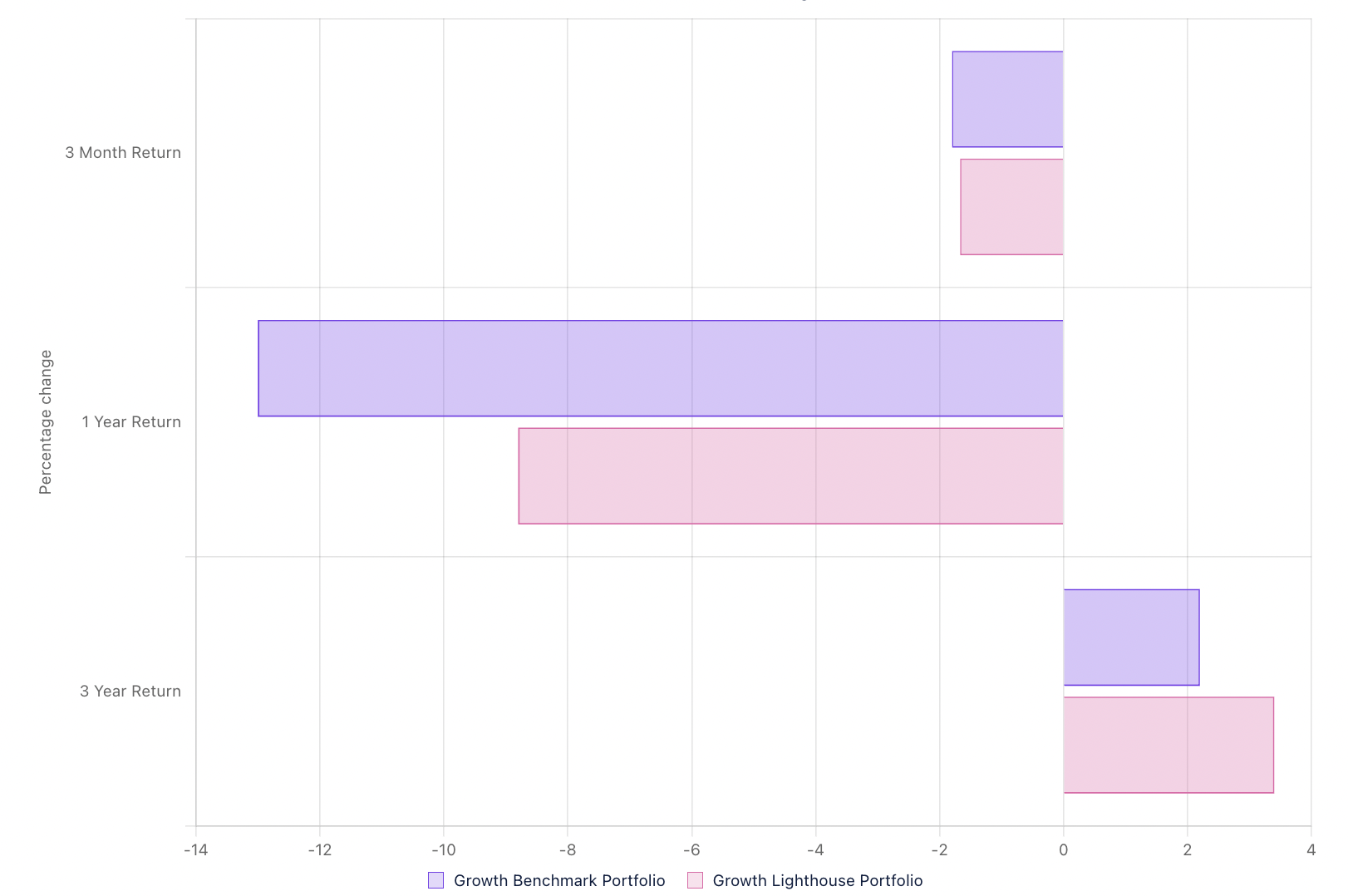

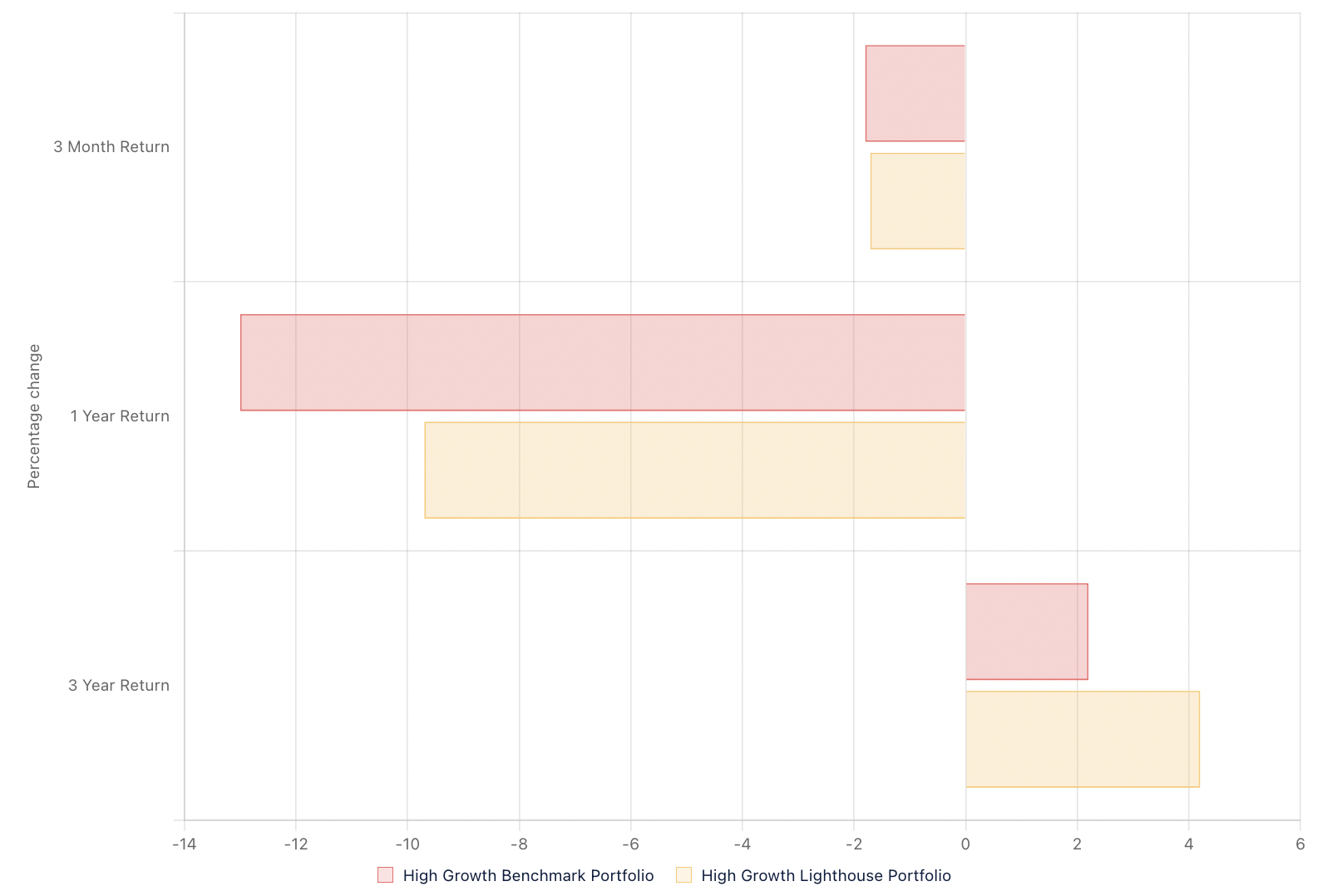

Your Portfolio Returns

There has been a general downturn in portfolio values this quarter, in line with market trends in 2022. That can feel disheartening, particularly after so many years of excellent results.It’s vital to remember that market declines are all part of the investing cycle. Historically, bear markets (where equities lose 20% or more in value) come around about every five years and last an average of 9.5 months – this one started in March 2022*.

In uncertain times like these, it’s important to focus on what you can control. Staying committed to your investment strategy in a downturn means you’re perfectly positioned to benefit from the following recovery.

Last year we made strategic changes across our portfolios with the introduction of the Man Alpha Fund at a 5% asset allocation and a reduction in long-duration bonds. This strategy has provided a buffer against ongoing interest rate volatility. It hasn’t yielded positive short-term returns for your portfolio, but it has mitigated some of the short-term risks.

Careful strategic management has also helped us to maintain our track record for exceeding benchmarked returns. Based on updated one-year returns, on average across our five model portfolio funds, we have outperformed the benchmark by 2.78%.

Adjustments we are considering

We currently maintain a 50% hedging in NZD across our asset classes (income and growth assets). This means that 50% of your funds are held in New Zealand dollars, and the remaining 50% are held in the local currency, where the investment fund originates (usually USD and AUD). In times of stress, investors seek haven in safer currencies, which can result in large-scale sell-offs of the NZD. To mitigate any associated risks to your portfolio, we are considering increasing our hedging position to 75%.

Short-duration bonds have played an important part in portfolios during this extreme volatility in bond markets. As interest rates begin to stabilise, we will seek lower exposure to short-duration bonds and return to post covid levels of 25% exposure.

Overview

James Blair

Wealth Director

+64 27 399 5175

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.