Welcome to Cheques and Balances. This week we are asking the question: are you behind in your retirement savings? The idea comes from an article that Milford released last year, where in a survey, they identified that 65% of Kiwi adults are worried about their retirement and 70% of those surveyed thought they’ll have to work past 65.

Introduction

There’s a few factors involved with calculating how much you need for retirement. When do you want to retire? What kind of lifestyle will you live in retirement?

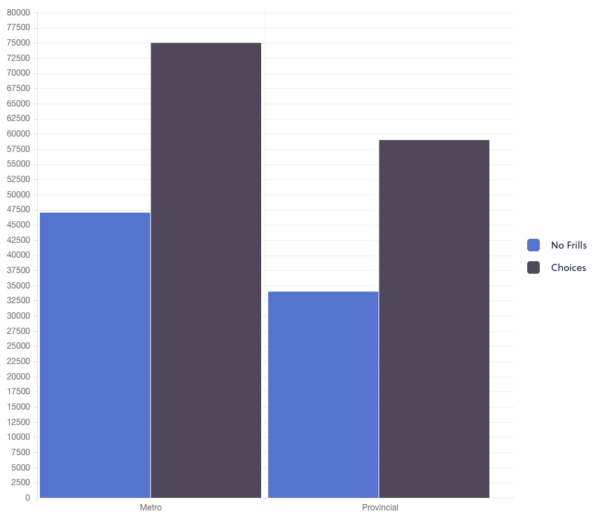

In Massey University’s 2019 New Zealand Retirement Expenditure Guideline Report, retirement lifestyles were categorised into 4 distinct categories; a ‘no frills’ lifestyle which reflects a basic standard of living, no Ponsonby lattes or trips to Fiji included. The ‘choices’ lifestyle represents a more comfortable standard of living, which includes some luxuries and treats. Lifestyle costs are further broken down into provincial or metropolitan areas.

No frills – Metro lifestyle will cost approximately $47,000 per year

No frills – Provincial lifestyle will cost approximately $34,000 per year

Choices – Metro lifestyle will cost approximately $75,000 per year

Choices – Provincial lifestyle will cost approximately $59,000 per year

Retirement lifestyle costs per year

NZ Superannuation

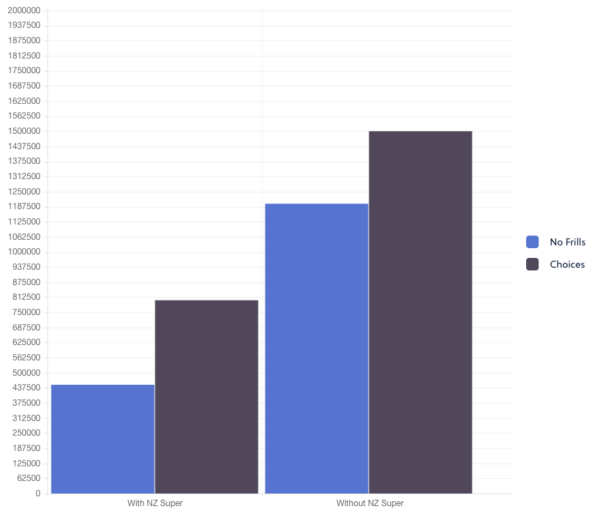

So how much do you need to retire at 65? There’s one huge variable to consider; NZ Superannuation.

NZ Super is about $20,000 for individuals and $33,000 for couples, this amount extrapolated over a 30 year retirement period is about $750,000 – $800,000 in total. Why is this important?

Well if you’re reading this and are under 50 years old, you should have the mindset that you’re not going to get NZ Superannuation, why? Simple math – Ageing population + less babies being born = less tax being paid to fund NZ Super. The government has known this and launched the KiwiSaver programme over 15 years ago to eventually replace NZ Superannuation.

For our clients under 50, their financial plans include strategies for them to achieve the lifestyle they want without NZ Superannuation included.

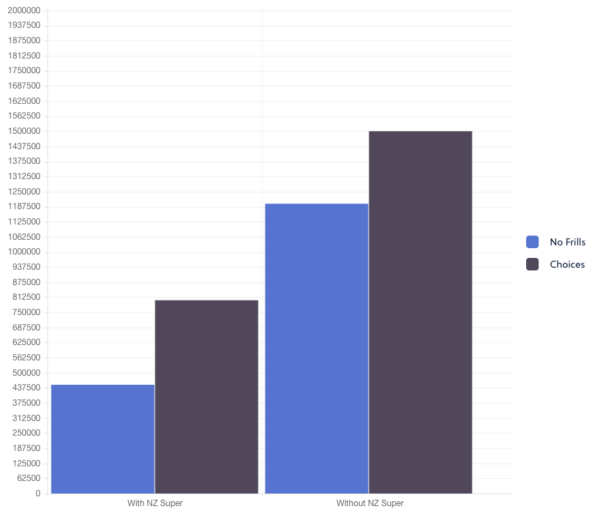

For the majority of Kiwi’s, NZ Superannuation won’t be included in their golden years, so how much extra do you need to save? See how much you need to save for a city lifestyle with and without NZ Super below:

How much you need to save with/without NZ Super

For a choices lifestyle without NZ Super, you’ll almost need to find almost double the amount of money. The difference is staggering. Even to have the bare minimum, you’ll need to have $1.2m come 65. Even scarier in a time when we’re experiencing record inflation and interest rates.

Another important consideration here is that this is assuming you’re eroding your capital over time, so if you’ve got goals to leave an inheritance for your kids, you’ll need to factor in even more.

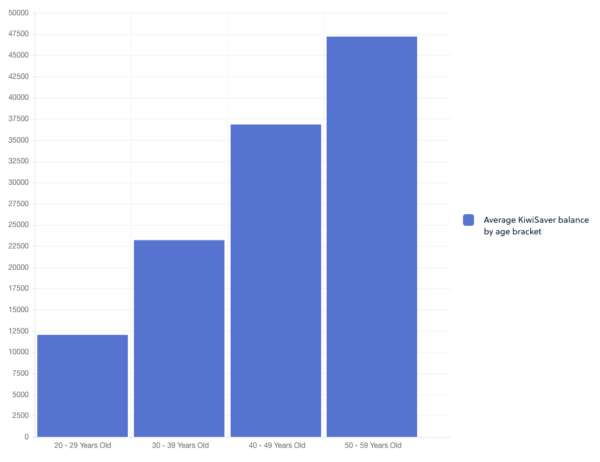

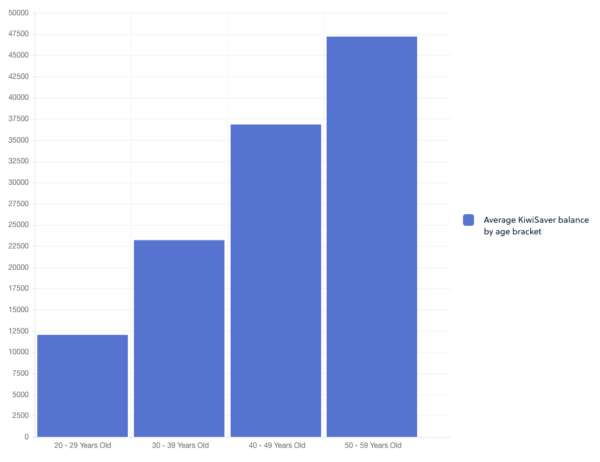

Average KiwiSaver balance by age group

KiwiSaver will be the biggest asset for many Kiwis come retirement, so given the ambitious goals outlined above, how do we stack up? Here’s the average KiwiSaver balance by age group according to Melville Jessup Weaver’s 2022 KiwiSaver Demographic Study.

Sobering. However, there’s some key things to take into account when looking at these numbers:

- For those in their 20’s many of them would have just started work

- Many people use their KiwiSaver for a deposit into their first home

- KiwiSaver as a product, has only been around for 15 years and is still in its infancy as a retirement solution

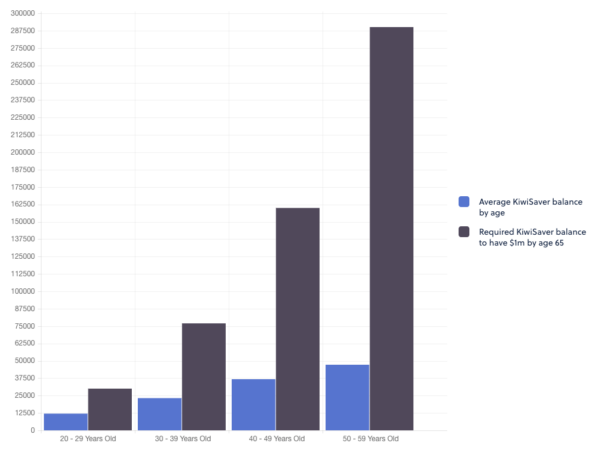

How much you should have in your KiwiSaver balance by age group

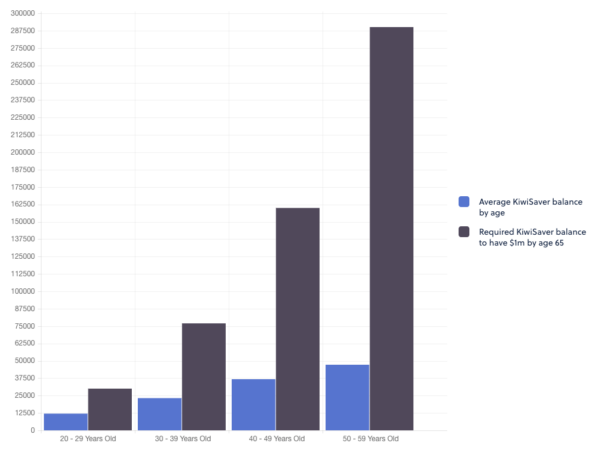

If you’re looking at the above numbers and giving yourself a pat on the back, take it back off. Let’s talk about how much you should have in your KiwiSaver to have $1m by age 65.

Some key considerations before we jump in:

- This is assuming you earn the average salary for your entire career

- You have no other assets that are generating long term wealth

- You are in a balanced KiwiSaver fund

- You use KiwiSaver as the only means to fund your retirement

- You only contribute 3% with the 3% employer match

The insight here, is that doing the bare minimum isn’t going to cut it and relying on KiwiSaver as one of your primary providers moving into retirement may not cover the the lifestyle you want to live.

So what should you do?

A common we get asked is, should you be increasing your KiwiSaver contributions, the answer will typically be no. Thats because they money is locked up for a really long time and those funds could be used to pay down debt or invest in an unlocked asset (index funds etc)

This where having a financial adviser can sometimes be invaluable to give objective advice on your attitude towards money planning, long term goals and retirement.

Another key insight is, the earlier your start, the better off you are and less you have to sacrifice. For example, if you’re 20, you have to save only 9% of your gross income to replace your income needed in retirement, that percentage increases to 49% if you’re 50. Small incremental steps will yield big results over a long period of time, it’s not sexy but it’s been proven 100% successful.

If you’d like to chat to our wealth team about your retirement, simply book in a free 30min discussion below

For a no obligation discussion to see how we can help you on the path to wealth, please contact us.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.