To show this concept, we’re going to be looking at the cashflows of three distinct households. They are:

- Poor households

- “Rich” households

- Wealthy households

On this podcast we talk a lot about market updates, strategies to help you get ahead and securing your financial future, but today we thought we’d talk a bit about the mindset of a wealthy person. Why is this important? For many of our clients and people watching/listening to this, their main goal will be to generate wealth, and how do you find out how to build wealth? Well, you study what wealthy people do.

To show this concept, we’re going to be looking at the cashflows of three distinct households. They are:

Now first thing to address – No one picks the circumstances that you grow up in, some people grow up in wealthy households, some grow up in middle-income households and some unfortunately grow up in poorer households, this doesn’t necessarily mean people living in poverty but maybe households with a single income, or people who are trying to support themselves and their wider family while on a lower income. Everyone’s circumstances differ when growing up, that’s something you can’t control, but the big lie here that the media likes to perpetuate, is that because you grew up in a poor household, you can’t transition into a wealthy household. It might not be easy but it’s not impossible either.

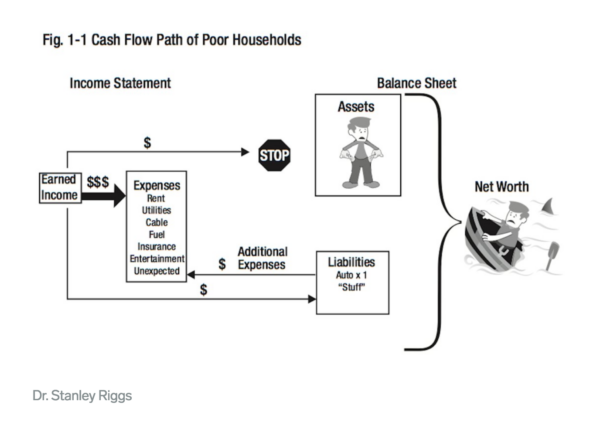

Looking at the cashflows – If you look at the left, you’ll see earned income, this is the money you earn from your job, you have to sacrifice your time and skills to earn this money.

In a poorer household, most of this money goes into fixed expenses, we’re talking your rent, utilities, food, insurance and unexpected expenses, we call this your 4 walls, these are things you can’t live without. This is where the majority of their money goes. Any extra money tends to go to liabilities, usually in the form of vehicles. To put this in perspective, the average car loan payment in the U.S is around $644 a month, thats a 15% increase from 2021.

Now here’s why unfortunately poorer households can be cyclical in nature. Liabilities are things that take money away from you, this is because the value of that thing, generally goes down AND costs you money in terms of regular maintenance or interest on a loan. You’ll see here that no money goes into assets, assets are things that put money into your pocket, either through the value of that thing going up, or passive income like dividends or rental income.

So if you find yourself in this position – What should you do? Your biggest asset is yourself and your earning potential, if you can find ways to increase your income, either through changing jobs or asking for a pay rise AND re-directing any money you can into assets, you’ll start to change your trajectory.

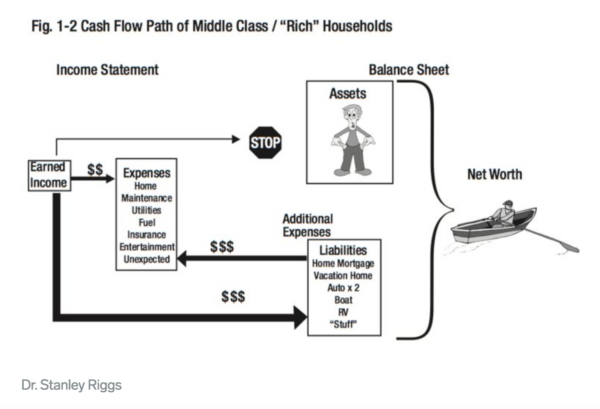

Now we’re on to “Rich” households

This is most households in NZ. These are households who have started to get better jobs, make better salaries or wages but unfortunately they are no better off than the poor households, let’s see why.

You’ll see on the left that their earned income line is much bolder, this is because they are earning much more money, these might be households that have moved from $50 – 70k a year to $100 – $150k a year, they might be even be making $150 – $200k a year

But let’s see where that money goes, some of it is going to their 4 walls, however the majority of it is directed to more liabilities, these liabilities have grown with their salary, in the form of upgraded cars, to luxury clothing, to upgrading the family home or buying a boat. Slowly, but surely, as they have increased their salary, their lifestyle has too.

This is the exemplification of lifestyle creep. As you’ve grown your salary, your lifestyle costs have grown with it, so you’re no better off than the “poor household”. You’ve left nothing to grow your wealth.

This is people who are superficially “rich”. People with plenty of toys, the new tesla, new phone, fanciest clothes and probably showing it all off on social media – however all those things decrease in value over time.

This mentality keeps you shackled to your job, meaning in order to enjoy more, you have to find a way to earn more. It sounds like a stressful way to live, and it is.

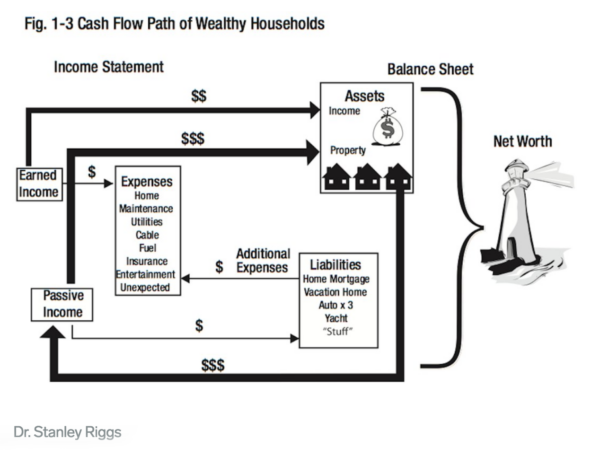

This is truly wealthy households. This is in our opinion is the best exemplification of the fundamental shift that needs to happen in your cashflow to change your future for yourself and your family.

Let’s have a look – As always, earned income goes to fixed expenses, wealthy households try to minimise their 4 walls cost as much as possible because they understand money. They know expenses and liabilities take money out of their pocket.

The vast majority of earned income, goes to assets, assets gain in value over time and pay a passive income, the two most popular asset classes are property and shares. These things go up in value over the long term, they also create “passive income” Now there’s a quote we love from Warren Buffet, he says “If you don’t find a way to make money while you sleep, you will work until you die.” Passive income is income you don’t have to work for, it is income that is created while you sleep. This is the the key difference that separates the wealthy and the rest of us.

So why do wealthy people get exponentially more wealthier? Well when you take that passive income that you make while you sleep and re-invest it into more assets, that has a compounding effect and grows your wealth like a snowball down a hill. The more you add to this snowball, the faster it grows, the more time you give this snowball, the larger it grows. This concept is how the wealthy get ahead.

So how common is this passive income thing?

Tom Corley, author of “Rich Habits: The Daily Success Habits of Wealthy Individuals.” conducted a survey of 233 self-made millionaires over 5 years and found:

65% of all self made millionaires had at least 3 streams of income. 45% had at least 4 and 39% had 5.

No matter their background or industry, One of the most common traits among self-made millionaires is their ability to create multiple streams of income. Every single one of the self-made millionaires in the study started small, adding one new income stream at a time.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.