Even though rent goes up, it's still not keeping pace with the costs of looking after properties. So, why is this happening? We have teamed up with Valocity, New Zealand's top property valuation company, to find out.

Overview

Insights By

Here’s a puzzle: even though rent goes up, it’s still not keeping pace with the costs of looking after properties. So, why is this happening? We have teamed up with Valocity, NZ’s leading property valuation and data platform, to find out:

The Current State of Rentals

Rental prices are dictated by several factors: the property’s condition, the availability of rentals in the area, overall market demand, and the size of the accommodation. Although rental prices have seen growth, other cost increases have outpaced them.

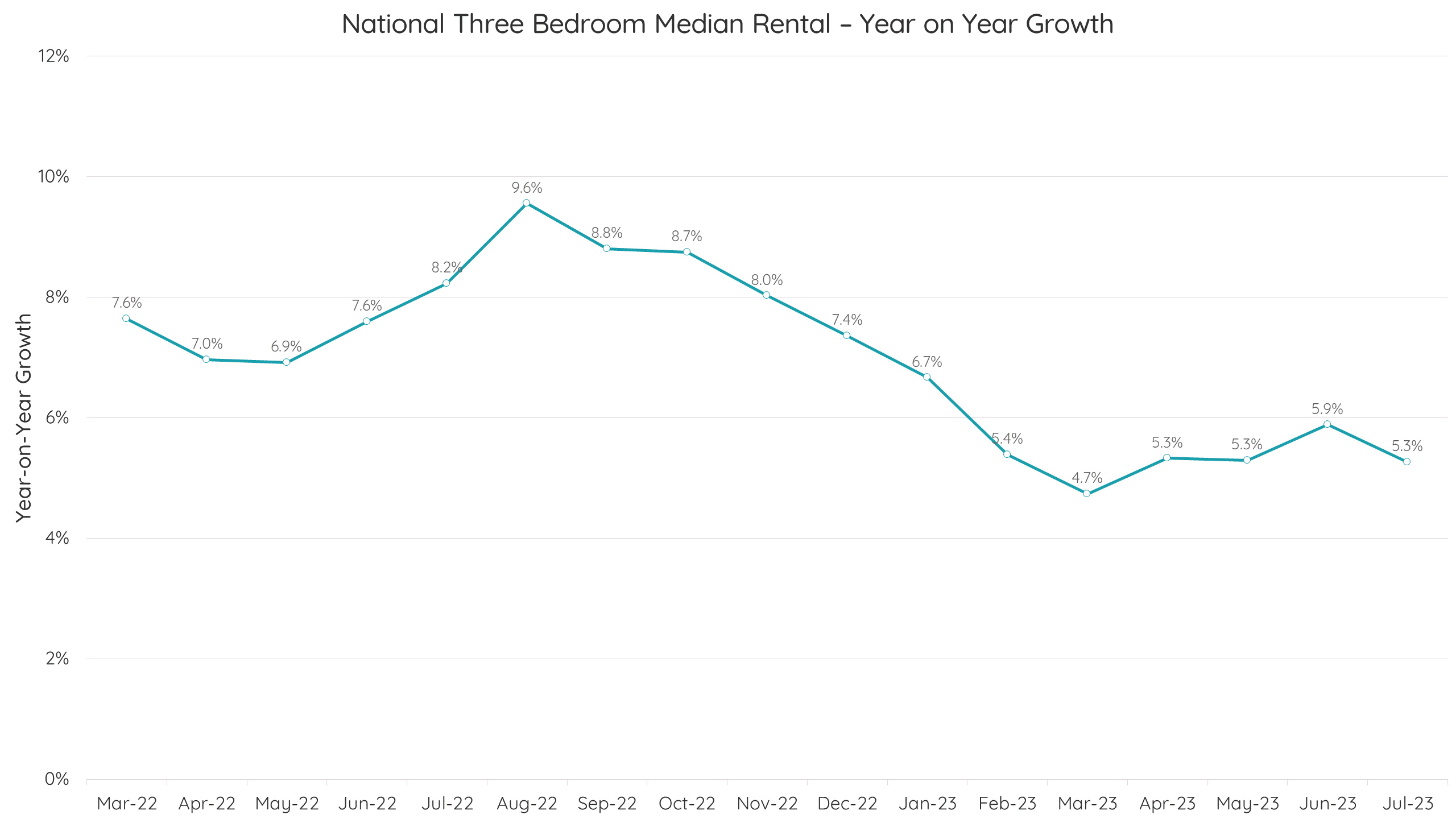

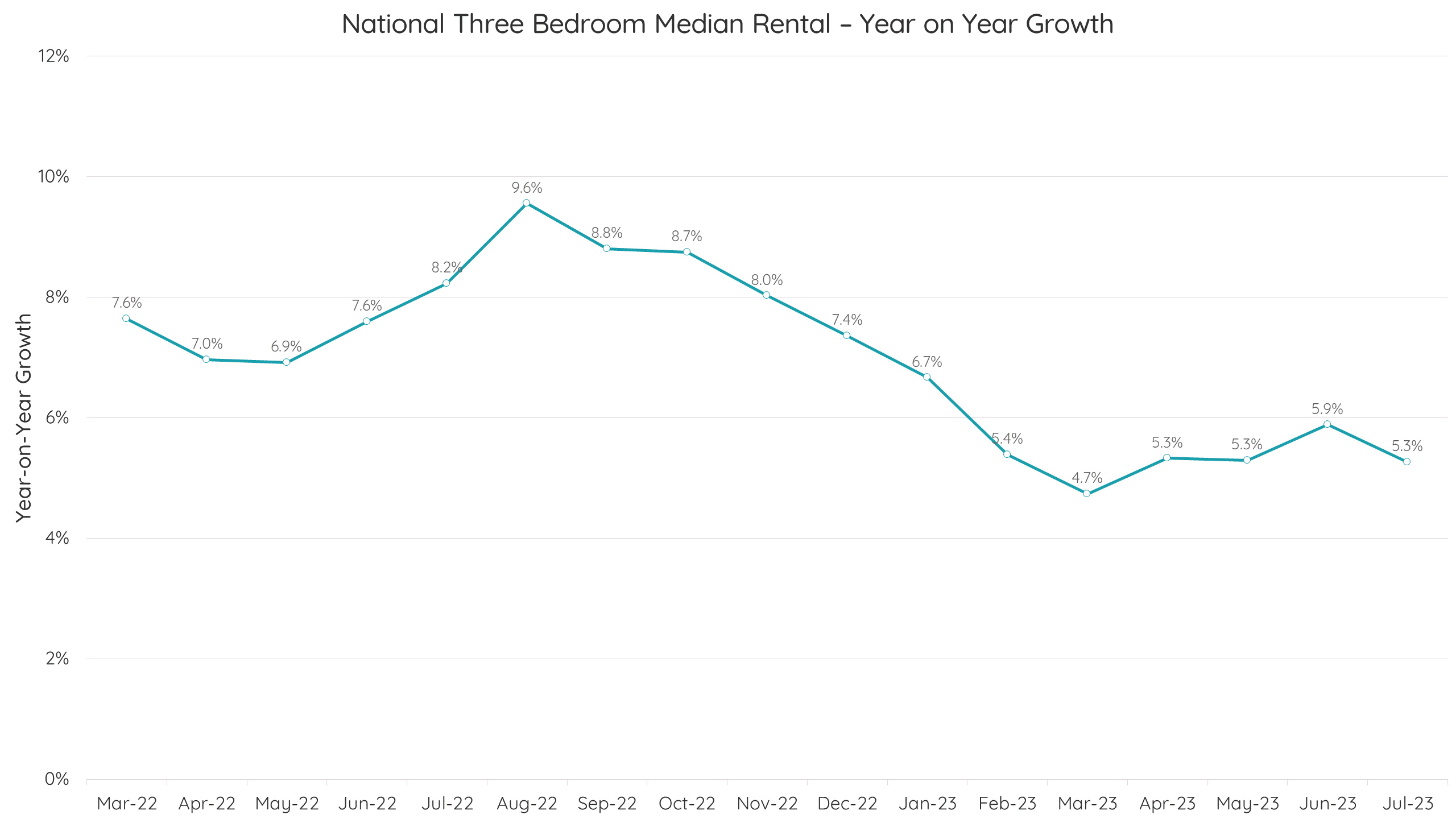

In 2023, annual rental growth fell to 5.3%, lower than the Consumer Price Index (CPI) at 6.7% per annum. Simultaneously, rental cost growth outpaced wage growth by 4.3% for the year ending in March. With the CPI growing faster than wage growth, individuals have less disposable income available for rentals.

The Rising Cost of Property Ownership

The cost of owning property involves many factors, most of which are experiencing significant increases. Auckland Council recently announced a 7% increase in rates this year, and other territorial authorities are following suit with their high increases.

The insurance industry is undergoing a shift as well. Recent weather events have led to a reassessment of insurance risks and premiums by insurers. The cost of rebuilding after such events is inflating faster than the CPI, leading to longer reconstruction periods and, therefore, higher insurance premiums.

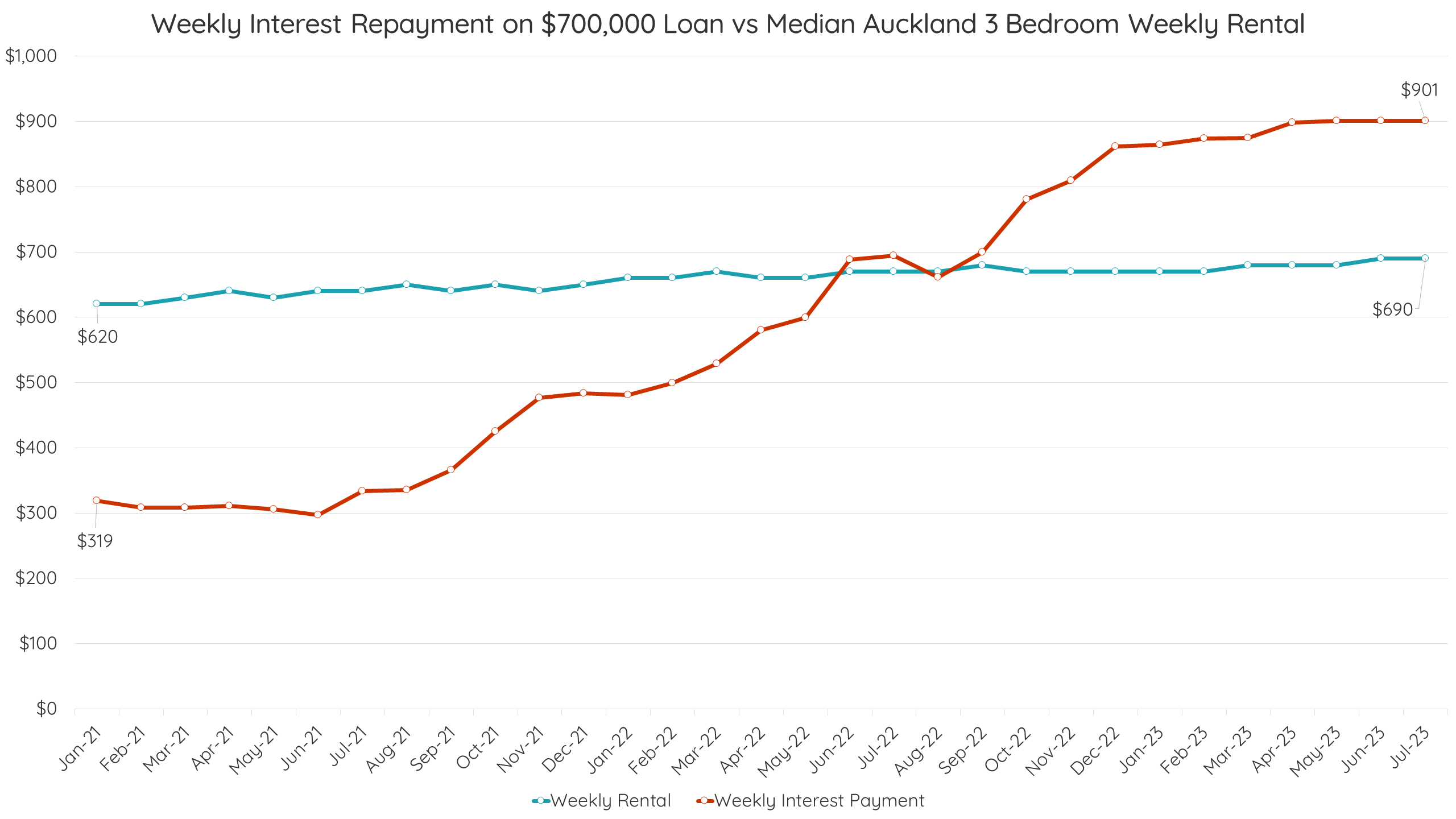

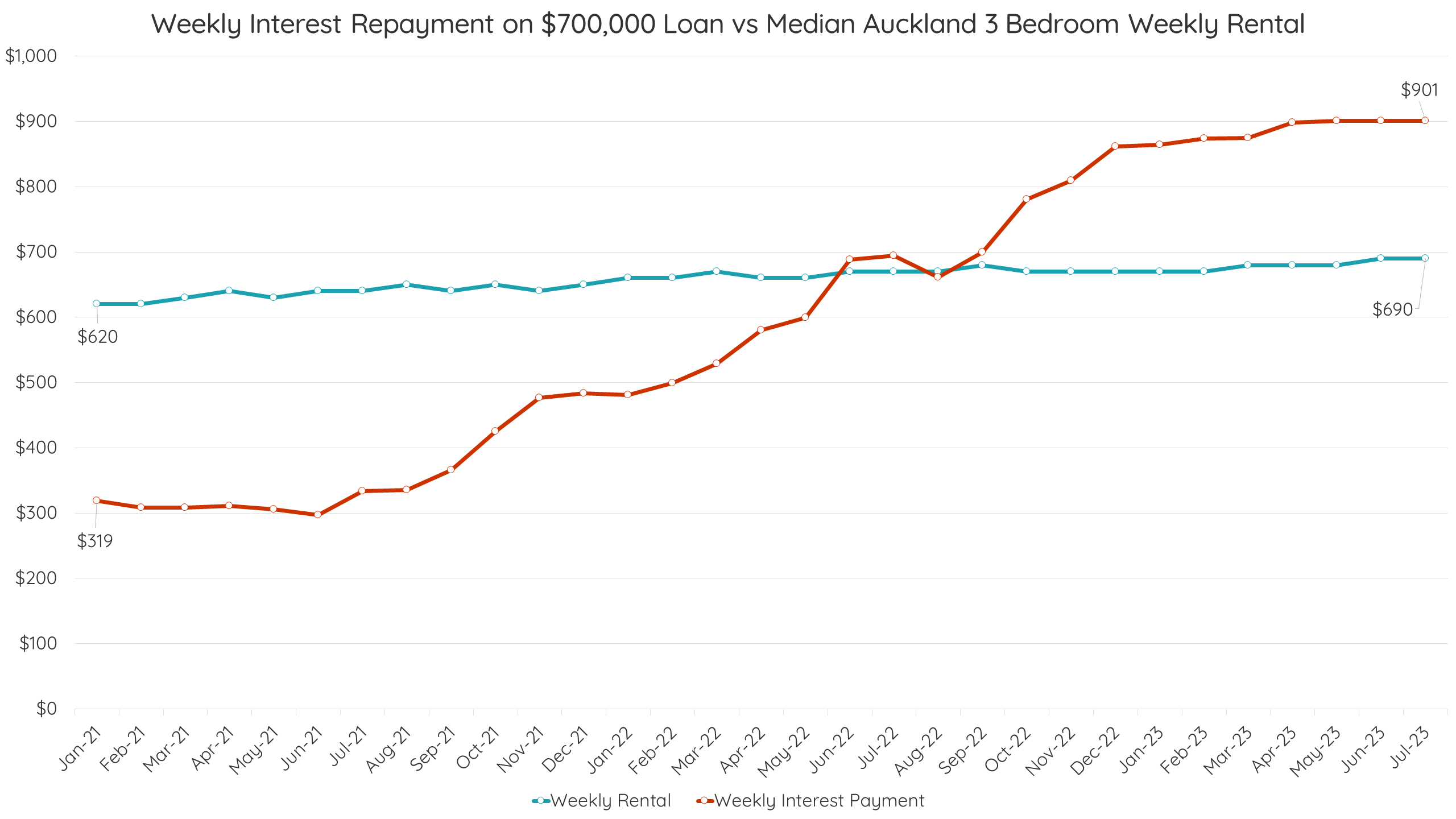

The landscape for property investors has also changed. The phasing out of interest deductions for properties purchased before March 2021 reduced cashflow for investors. Additionally, the mortgage rate – the largest determinant of holding cost – has seen a swift increase, from a record low of 2.4% in early 2021 to a decade high of 6.5% in 2023. Interest repayments have nearly tripled since early 2021 due to these rate hikes.

The Cashflow for Investors

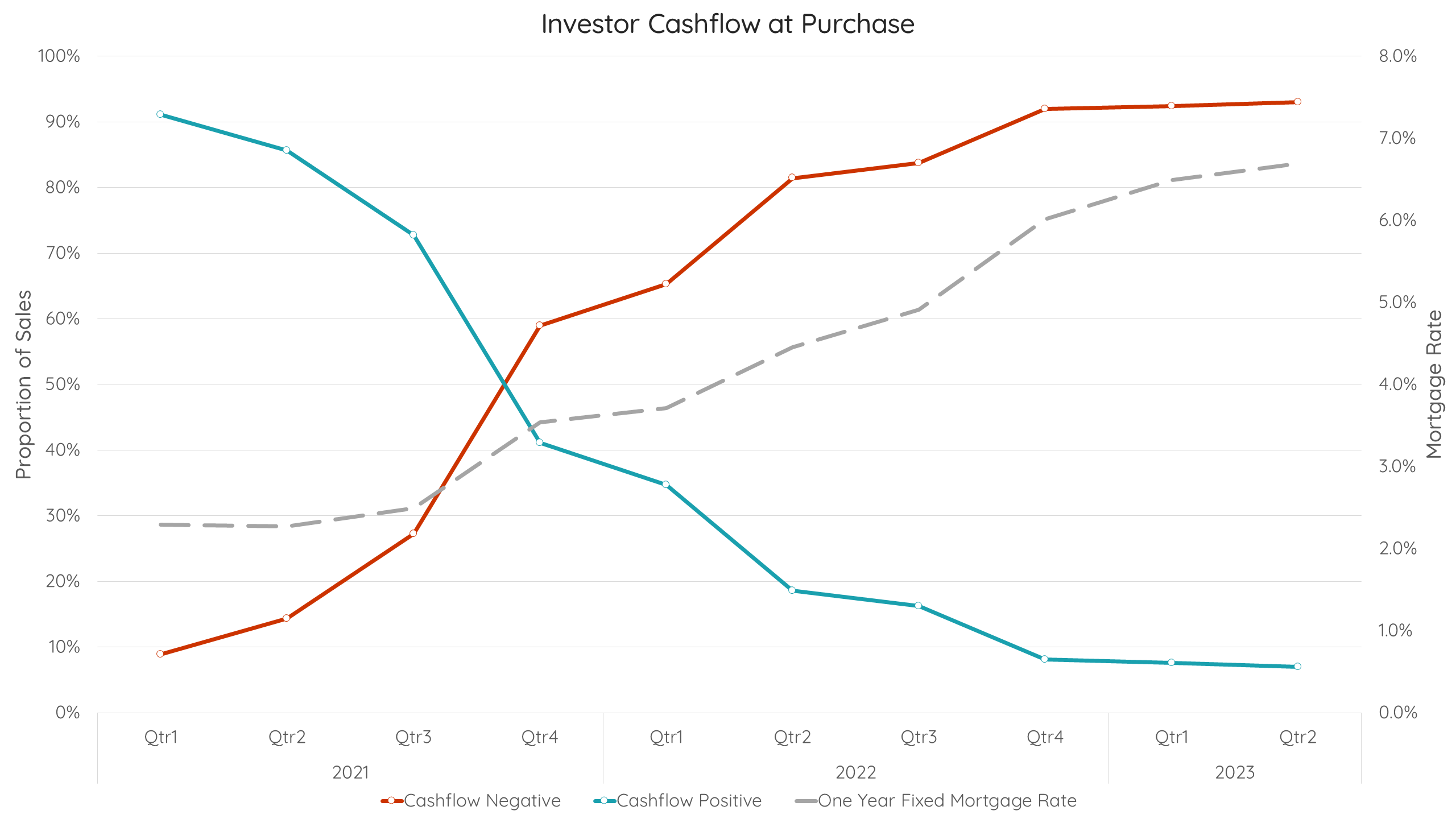

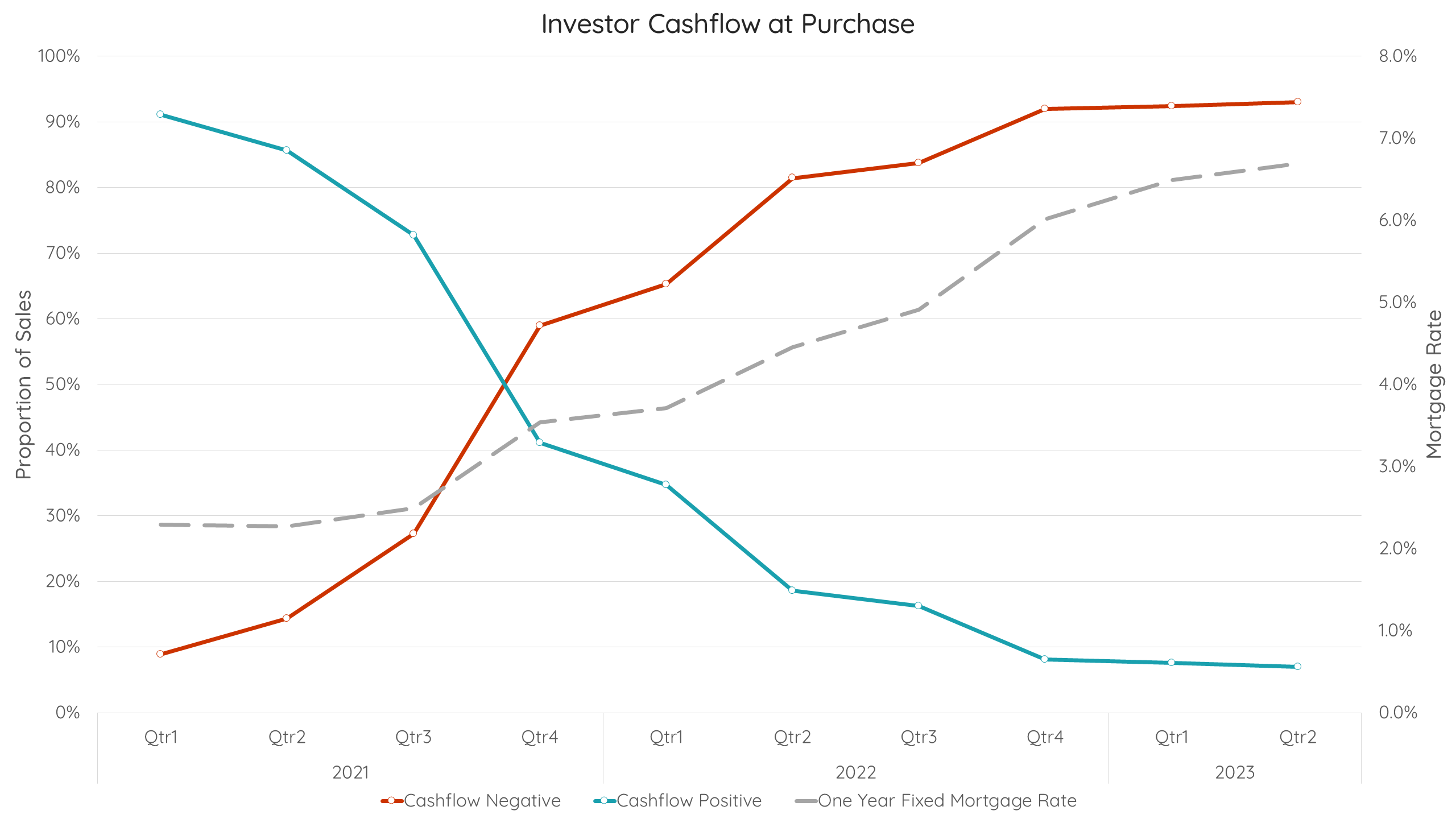

Valocity has conducted an in-depth analysis of homes purchased by investors since 2021. The analysis used factors such as purchase price, market rental at the time of purchase, and the prevailing 1-year fixed mortgage rate at the time of purchase, assuming a 100% mortgage.

The findings reveal a turning point in Q3-2021. As mortgage rates rose, properties with negative cashflow became more prevalent than those with positive cashflow. To compensate for this cashflow shortfall, investors have relied heavily on positive property value growth. However, lower prices throughout 2022 and 2023 failed to reverse the trend as mortgage rates continued to rise.

The Impact of Wage Growth and Cost of Living on Rentals

The growth of rental costs is inevitably tied to wage growth and the rising cost of living. These factors form a natural ceiling price on rentals. Tenants simply cannot afford to pay more, particularly as wage growth lags behind inflation. Despite this, costs for property owners continue to rise at rates higher than inflation.

This imbalance has resulted in rents not keeping up with the escalating costs, leading to a growing cashflow shortfall that investors must bear.

For a no obligation discussion to see how we can help you on the path to wealth, please contact us.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.