This week - what happens after the world falls apart and the stock market crashes?

Introduction

The first 6 months of 2022 has been the market’s worst start to the year since the 1970’s. The second largest crypto exchange has filed for bankruptcy, inflation still runs rampant across the world’s economies and interest rates have doubled in the last 12 months. It’s no doubt that we’ll be welcoming in a recession next year (if we aren’t in one already), but what happens after a recession? We studied history’s biggest recessions and found out what happens after a big drop in the stock market.

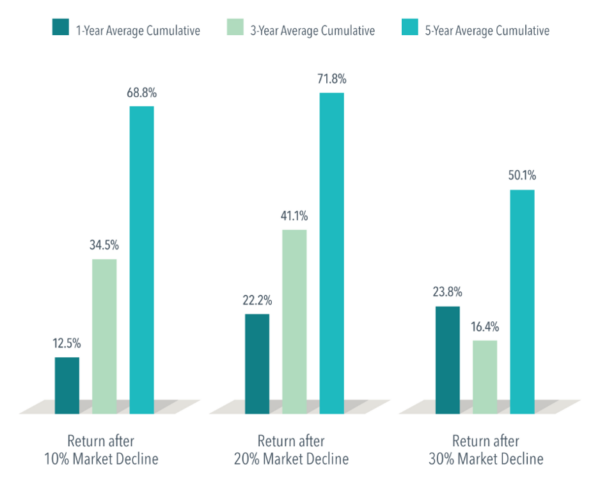

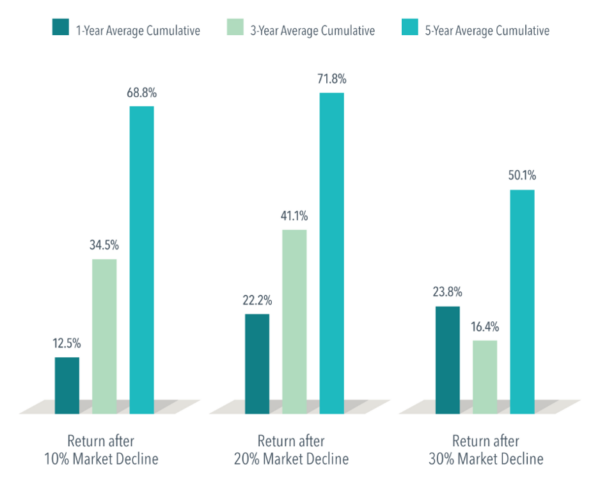

There have been 5 big market crashes in recent history, they are outlined below along with the time it took for the market to recover each time.

The Great Depression

The longest, deepest, and most widespread depression of the 20th century. During the 1920s the U.S. stock market underwent a historic expansion. As stock prices rose to unprecedented levels, investing in the stock market came to be seen as an easy way to make money, and even people of ordinary means used much of their disposable income or even mortgaged their homes to buy stock. By the end of the decade hundreds of millions of shares were being carried on margin, meaning that their purchase price was financed with loans to be repaid with profits generated from ever-increasing share prices.

Once prices began their inevitable decline in October 1929, millions of overextended shareholders fell into a panic and rushed to liquidate their holdings, exacerbating the decline and engineering further panic. Between September and November, stock prices fell 33 percent. The result was a profound psychological shock and a loss of confidence in the economy among both consumers and businesses.

The Great depression lasted 10 years and did not recover until 1941. Currency devaluations and monetary expansion were the lead sources of recovery throughout the world.

The Dot Com Bubble

The notorious “dot-com” bubble—also known as the tech boom or internet bubble—was a period from about 1995 to about 2001 during which internet-related tech companies attracted a massive amount of attention from venture capitalists and traditional investors alike.

This influx of money combined with the exploding popularity of the internet in general caused the web sector to expand rapidly in terms of valuation over the course of a few years despite many companies lacking concrete paths to profitability. Low interest rates in the late 1990s made debt financing easier for young, ambitious tech companies to acquire, further fueling the internet industry’s unchecked growth.

Eventually, around late 2000, these streams of easy money dried up, and the industry imploded, causing many tech companies to go under and ushering in a new bear market that would last for around two years and affect the entire stock market—not just the technology sector.

This recession was relatively mild. It began 13 months after the tech bubble burst and lasted eight months. It was worsened by the 911 tragedy which occurred six weeks before the recession ended.

The 2008 Financial Crises

The financial crisis was primarily caused by deregulation in the financial industry, that permitted banks to engage in hedge fund trading with derivatives. Banks then demanded more mortgages to support the profitable sale of these derivatives. They created interest-only loans that became affordable to subprime borrowers.

Predatory lending targeting low income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a “perfect storm.” Mortgage-backed securities tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

The recession lasted 18 months and was officially over by June 2009. However, the effects on the overall economy were felt for much longer. The unemployment rate did not return to pre-recession levels until 2014, and it took until 2016 for median household incomes to recover.

What can we learn from these crashes?

While all these market crashes seem unique in nature. All of them were followed by healthy market growth and a continuation of the global economy. When zooming out and looking at these unprecedented occasions, the drops seem small in comparison. Also observed is how the media repeatedly use these opportunities to generate more revenue by painting dire economic pictures.

Don’t Panic and concentrate on the long-term

Selling crystallises losses. It may take some time, but your assets should return if you hold. Long-term investors are almost always better off ignoring even the most spectacular short-term market moves! Every single stock market meltdown in history has resulted in a recovery.

Don’t try to time the market

It’s impossible. Consider investing when markets are down; — they may fall farther at first, but if you invest a little at a time, you will profit from the dollar cost averaging.

Never speculate

Those who speculate in stock markets are often the ones who are hardest hit during market crashes. Speculation is best avoided by stock market investors who aim for wealth creation in the long run.

For a no obligation discussion to see how we can help you on the path to wealth, please contact us.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.