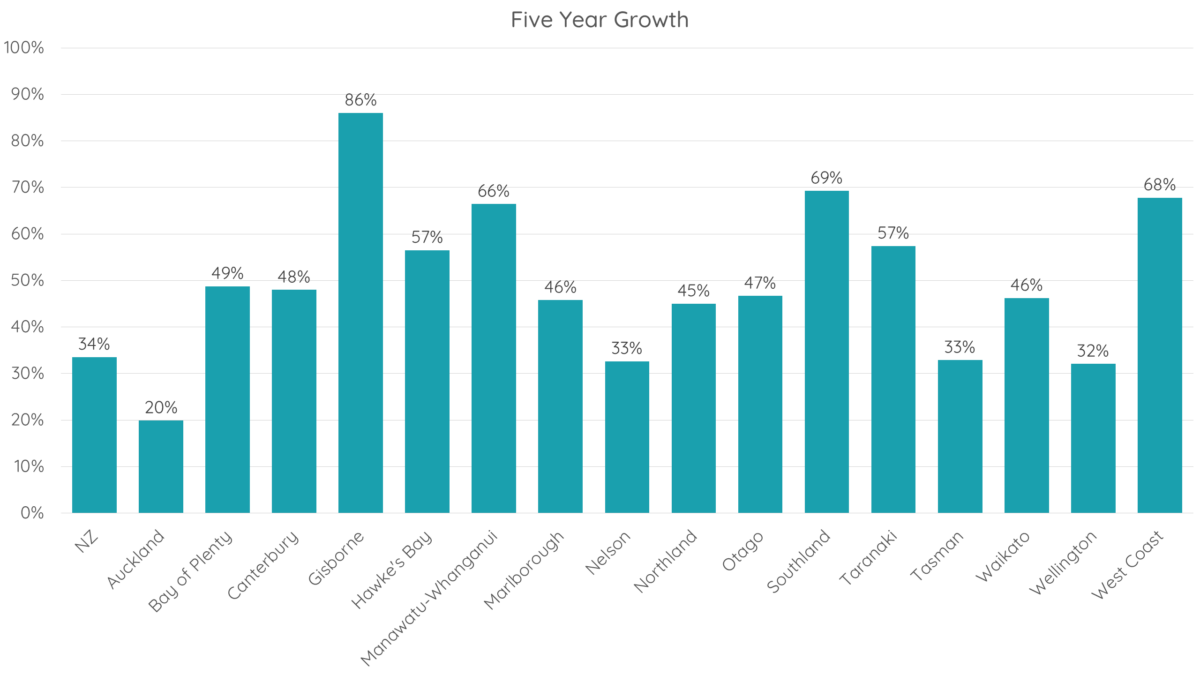

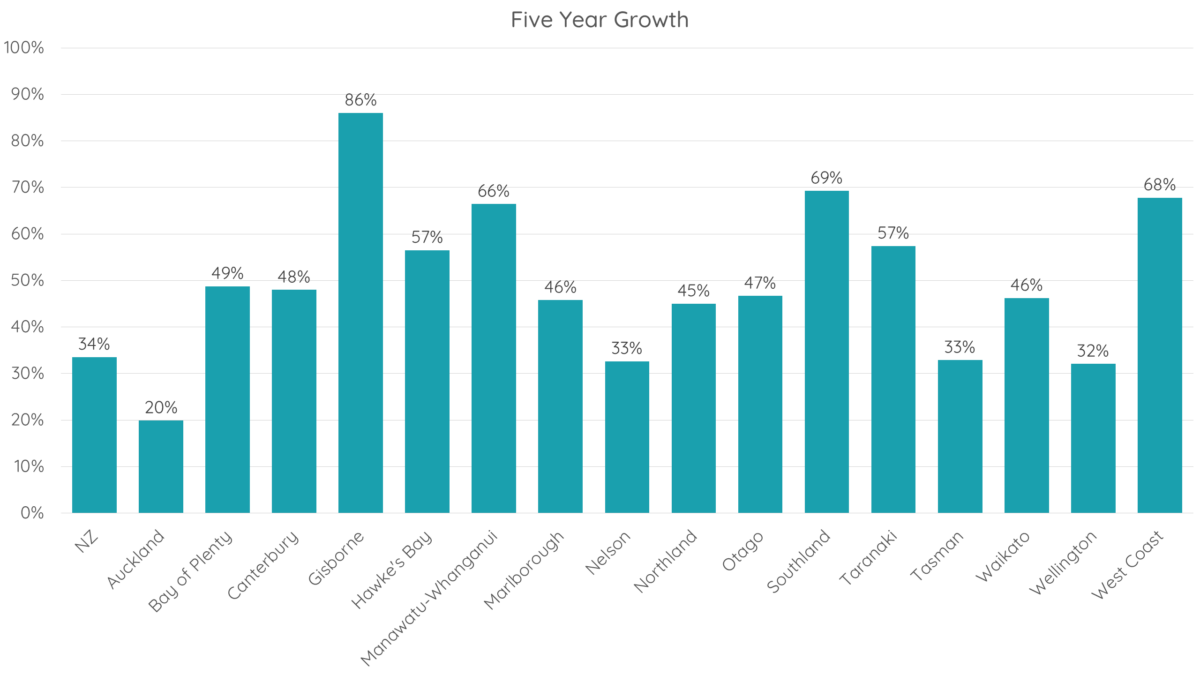

Over the past five years, the housing market in New Zealand has experienced significant growth. However, this growth hasn't been uniform across the country, and savvy investors are looking beyond the major cities to find the best opportunities for the next five years.

Insights by

Historic Performance

When it comes to real estate investment, location matters. Traditionally, investors have flocked to major cities like Auckland, Wellington, and Christchurch, expecting high returns. However, recent trends have challenged this conventional thinking.

Surprisingly, the highest growth rates in New Zealand’s housing market over the past five years were not concentrated in the major cities but in provincial centers. Auckland, Nelson, Tasman, and Wellington underperformed relative to the national performance. One of the reasons for this underperformance is the already high property prices in these cities, which acted as a natural ceiling on growth.

The COVID Effect

The COVID-19 pandemic has brought about a paradigm shift in the real estate market. With remote work becoming more prevalent, buyers began to explore options beyond the city limits. Here are some key factors that have driven these changes:

- Remote Work: As remote work became the new normal, buyers realised that they could take advantage of lower property prices in provincial centers while still being able to commute to the cities when necessary. The idea of a two-hour drive once in a while seemed more appealing than a daily one-hour commute.

- Investor Shift: Investors capitalised on low interest rates and the capital growth during the post-COVID boom. However, the equity growth from their existing homes often wasn’t enough for a deposit on investment properties in major cities. This prompted investors to shift their focus to provincial centers, where property prices were more accessible.

- Better Rental Yields: Provincial areas began to offer better rental yields than major cities like Auckland and Wellington. This made investing in these regions more attractive for those looking for rental income.

What’s in Store for the Next Five Years

As we look ahead to the next five years, several key factors are likely to continue shaping New Zealand’s housing market:

- Auckland: High net migration is expected to persist, with most newcomers choosing to settle in Auckland. However, many recent arrivals cannot immediately purchase properties, which will drive rental demand in the region. Rental returns are already increasing, boosting the appeal of investment properties.

- Gisborne: Known for its strong rental yields, Gisborne is unlikely to see a large increase in rental stock. Building costs are prohibitive for new construction, making existing properties more valuable.

- Palmerston North and Dunedin: These cities are expected to benefit from the growing tertiary education sector. With an influx of international students from Southeast Asia, rental demand is likely to increase, offering investment opportunities.

- Bay of Plenty: This region is a popular choice for those seeking a better lifestyle while remaining commutable to Auckland. Tauranga and Rotorua are expected to attract both occupiers and investors, with the latter benefiting from attractive rental yields.

- Queenstown-Lakes: This area will continue to attract tourists, which means strong and growing rental demand. Investors can choose to operate short-term or long-term accommodations based on seasonal needs.

Conclusion

The New Zealand housing market is in a state of transformation, driven by changing work dynamics, investor behaviour, and shifting preferences. While Auckland and major cities will remain attractive, the best opportunities for the next five years might just be found in the provincial centers, where property values are more accessible, rental yields are higher, and the potential for growth is on the horizon. As investors explore these emerging markets, they should do so with a keen understanding of their financial goals, timelines, and risk tolerance, always keeping in mind that real estate investment comes with its unique set of challenges and opportunities.

For a no obligation discussion to see how we can help you on the path to wealth, please contact us.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.