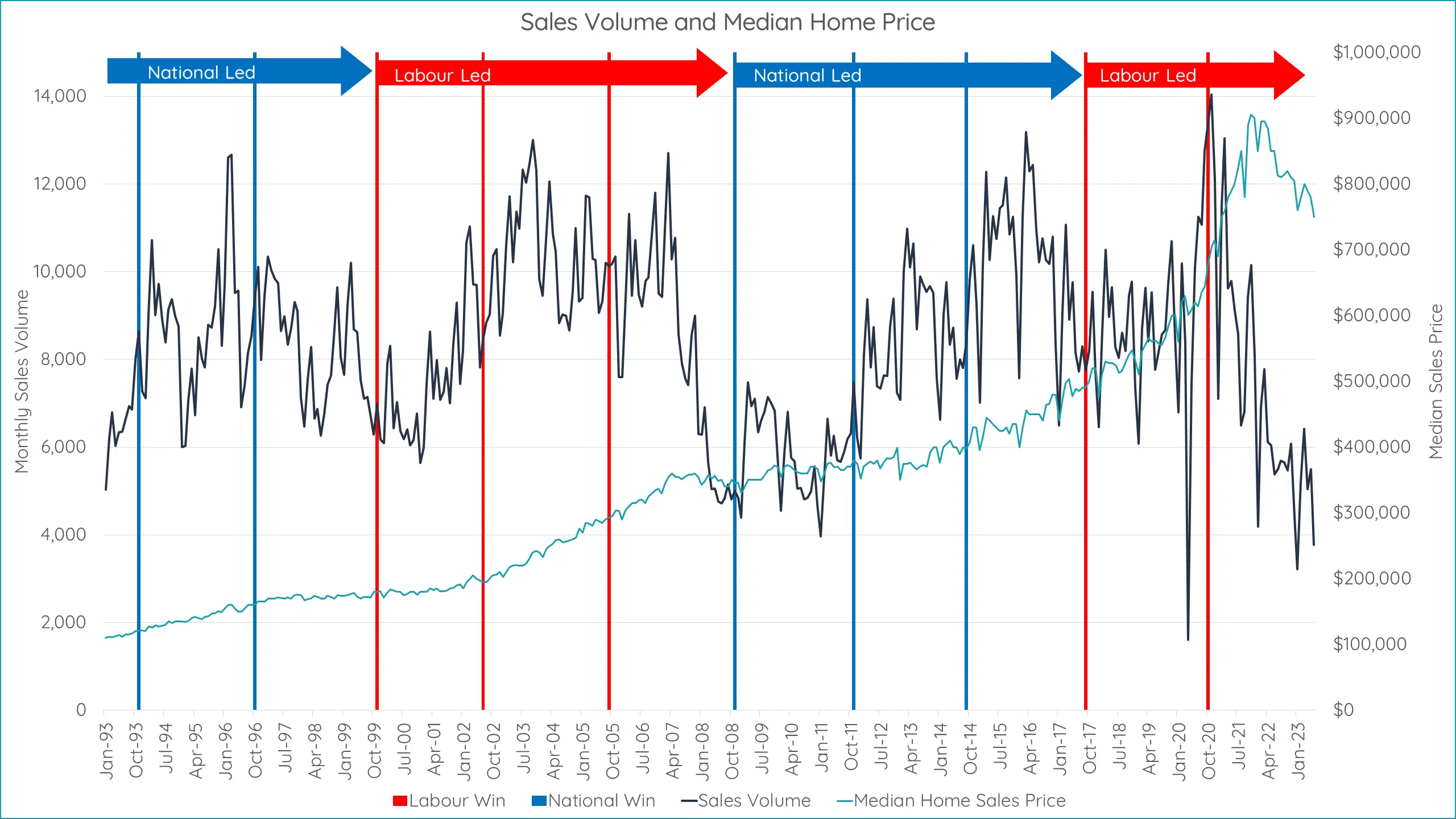

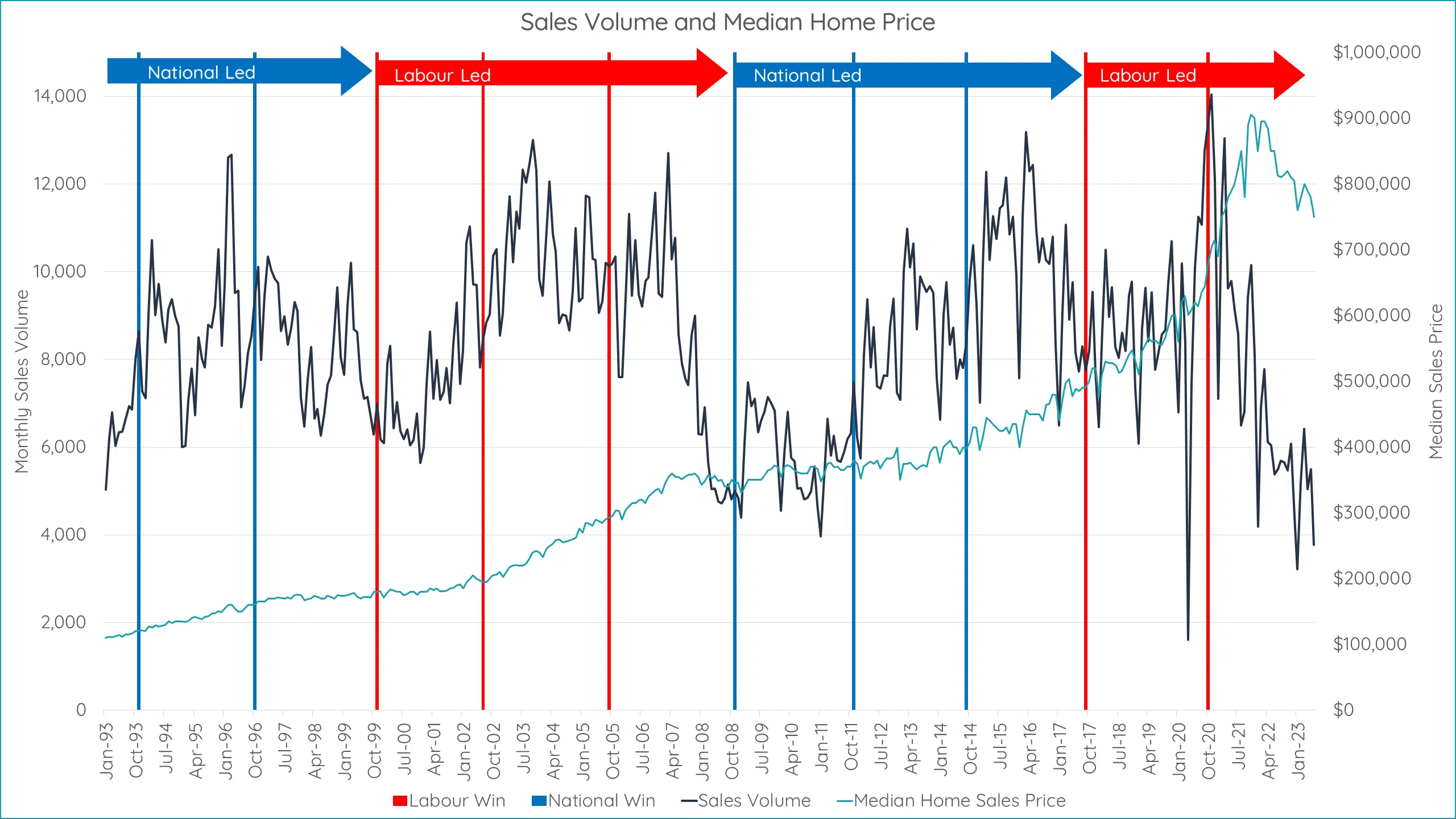

We get over 30 years of data from Valocity to see if and how house prices change under a National or Labour government.

Overview

The looming 2023 General Election, with its backdrop of decade-high mortgage rates, has the property market in a state of flux.

Compared to 2020, the current electoral situation feels much closer. One of the most significant barriers for potential homebuyers is the current high mortgage rates. As a result, many prospective buyers are adopting a wait-and-see approach.

Historically, the period leading up to an election tends to be characterised by uncertainty, which causes a dip in market activity. This could be a false cause as NZ elections typically happen in October, with winter months also causing a dip in the housing market and the summer months naturally creating more activity.

This trend isn’t just about the anticipation of the election day but extends to a six-month window around it. Interestingly, while market volume might shift, house prices seem to remain stable. This is likely because both buyers and sellers become more cautious, balancing each other out.

Party Policies and Their Potential Impact

While predicting the outcome of the election is impossible, one can delve into each party’s policies implications for the property market.

Under a Labour-led government:

- They are open to adjusting the Medium Density Residential Standards, allowing for more housing intensification in inner cities.

- Their commitment to making housing affordable continues with initiatives like First Home Loans and Grants.

- Properties priced and located in the range attractive to first home buyers are likely to benefit.

Under a National-led government:

- They propose unlocking greenfield areas for development.

- They would require councils to ensure land availability that can cater to 30 years of housing demand.

- A potential reintroduction of interest deductibility against rental income would be welcome relief for investors, especially in this high mortgage rate environment. This could drive investor demand back into the market, creating competition.

- The proposal to revert the Brightline Test back to two years would allow some investors to capitalise on their gains tax-free, increasing the property supply.

- Properties with development potential on city fringes might benefit, while inner-city brownfield development properties might experience a slower recovery.

What the data shows

The election’s impact, or perceived impact, on property decisions varies among individuals. Despite the chatter, the data indicates that over the past 30 years, there isn’t a significant correlation between the ruling party and better property price performance. Whether under a National or Labour government, the property market seems to follow its own rhythms, largely dictated by broader market cycles.

However, this year might be unique. Property has grown as a focus for New Zealanders, and consequently, politicians, over the past couple of decades. Given the specific housing campaign points of both Labour and National, this election might spur some noticeable activity in the housing market.

So, what’s expected post-election? Irrespective of the electoral outcome, Mike predicts a rise in property prices. “After the election, no matter who wins, I predict that property prices will increase over the next 12 to 18 months,” he said, basing this on market forces and economic cycles, rather than political changes.

In conclusion, while the election and its outcome might cause ripples in the property market, it’s the broader economic and market cycles that dominate its ebbs and flows.

If you found these insights helpful, don’t forget to subscribe, review, and stay tuned for more insights from our team.

For a no obligation discussion to see how we can help you on the path to wealth, please contact us.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.