We're starting to see more and more clients who are buying their first home a little later in life, but is it the right financial decision? We crunch the numbers

We’re starting to see more and more clients who are buying their first home a little later in life. This is for a variety of reasons:

- Travelled a lot when they were younger

- Needing to save a large deposit

- Not taking action and trying to time the market

- Having a lack of financial literacy

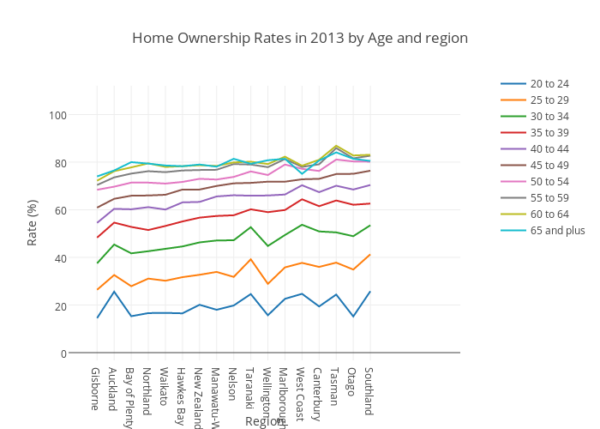

While social media might make you think it’s normal for 25 year olds to be on the property ladder. NZ Statistics data shows that the average age for Kiwi’s to be buying their first home is around 35.

Taking out a 30 year mortgage at 40 means you will still be paying off your mortgage 5 years into retirement, more importantly it means you don’t have enough time left for the sprint

(click here for the podcast on the sprint).

This leaves you very little time to create enough wealth to comfortably live out your years in retirement.

The other factor to consider is that at 40, you are generally less flexible on your lifestyle; including location, number of rooms, school zones and house quality. There’s a chance you will have a family requirement to consider too, this results in a more expensive house and a bigger mortgage.

The pros of home ownership:

- You get the capital gains of the property.

- You can’t get kicked out of your own home.

- You can invest into the house to make it exactly how you want it.

- You might be happy renting now, but what about when you’re 80?

The cons of home ownership:

- You are committed to a mortgage for a 20 – 30 years.

- There are always unexpected repair and maintenance costs.

- There is less flexibility with travelling or working abroad long term.

- Property values can fall and positive returns are never guaranteed.

Age of couple – both 40 years old with 2 kids

Salary – $150,000 pa each

Household expenses – $90,000 pa excluding rent

Rent – $900 per week

Cash savings – $350,000 – half is from a recent inheritance

If they bought

If they were to buy, they would purchase a house for $1,500,000 with a $1,200,000 mortgage. The repayments on a 30 year term would be $7,150 per month, which results in them paying 2.16 times the value of the mortgage – A whopping $1,390,000 in interest.

They would need to squeeze their budget to pay an extra $1,000 per month to have the mortgage paid off in 20 years. This would allow them to be debt free at 60, leaving them 5 years to aggressively save for retirement. They would have a projected $1,300,000 in KiwiSaver however, with their lifestyle they would run out of money at 85.

If they rent

If they were to continue renting, they could still purchase property but instead buy 2 investment properties at $800,000 each, with a 20% deposit and 4% rental yield. They would be paying principal and interest, which would leave both properties negatively geared by $40,000.

After they buy the properties, their annual cashflows are the following:

Income = $219,000 after tax and KiwiSaver

Expenses = $90,000

Rent = $900 per week

Topping up investment properties = $40,000

Investing to managed funds = $35,000

By 65 they would have:

2 debt free investment properties with a total $95,000 passive income

$1,050,000 in managed funds

$1,300,000 in KiwiSaver

Further to this, they wouldn’t be forced to sell their investment properties having $4,000,000 in assets once they are 100, leaving a substantial inheritance for their kids.

It’s ingrained in Kiwi culture to own your home, yet in this case study renting has a far better financial outcome than buying your own home. If home ownership is really important to you, that’s fine, but we recommend that you make an informed decision knowing the alternative options and their outcomes.

It’s never too late to start growing your wealth to achieve the life you have dreamed of. At Lighthouse Financial Services, we specialise in helping our clients grow their wealth though Business, Investments and Property.