People dream of getting onto the property ladder, but what happens after that? This episode breaks down the general steps to grow your wealth once you've just bought your first home.

Overview

We recently had some clients who had purchased their first home come to James and ask about what their next steps should be. People dream of getting onto the property ladder, but what happens after that? This episode breaks down the general steps to grow your wealth once you’ve just bought your first home.

A case study – Dan and Jen

Average age: 30 years old

Income: joint income of $200k and are expected to make $300k by 35

Mortgage: they just purchased a $1 million home with a $100k deposit – So a $900k mortgage

KiwiSaver: both KiwiSavers were used for the home, so there’s only $2,000 left

So what’s next?

We recommended to setup a joint account for house related costs including rates, house insurance, maintenance, power, water etc. We recommended they both get a Will in place as they now have a $1 million asset to consider if one of them were to pass away. We also recommended income protection as they’ve both bought an asset with the assumption that their income will be able to pay off the debt in the future.

Budget

Money isn’t magical. Creating and implementing a budget will mean they are moving towards their goals while also paying off the mortgage quickly. They could afford to spend half their income paying down the mortgage, with the other half being spent on living costs and short term goals.

KiwiSaver

Since they had spent all of the available funds from their KiwiSaver towards their house deposit. They had a 35 year time horizon until they could access the money again, that coupled with their risk profile meant they could move to an aggressive KiwiSaver fund.

Want to retire early with over $5 million?

Build a realistic budget to pay down debt and increase equity

Use KiwiSaver and other investment vehicles to maximise growth

Strategically invest in property to leverage your assets

Plan for tax efficiency, insurance, and long-term financial security

After 5 years

At this point Dan and Jen will do nothing for 5 years to reduce their debt and build some equity in their home. Small consistent steps over time build wealth, assuming they stick to their budget and their financial situation remains the same, in 5 years they will have enough equity to purchase their first investment property.

The investment property will have a $1 million value, with a 4.5% rental yield. The mortgage will initially be on interest-only, this is so Dan and Jen can concentrate on paying off their owner-occupier debt as fast as possible, as it’s more tax efficient to do so.

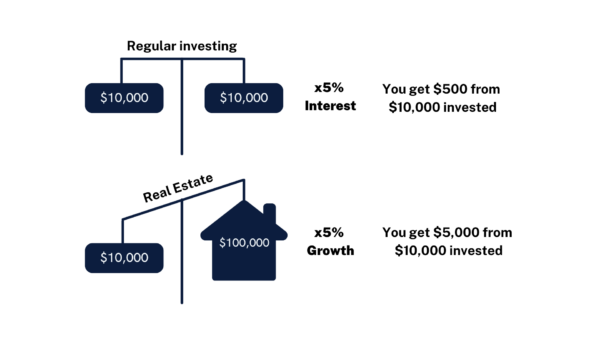

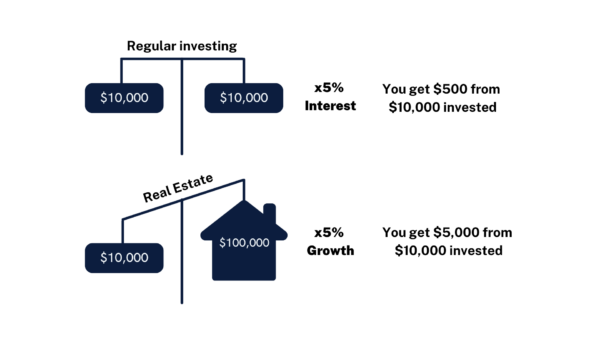

Why an investment property?

When you purchase an investment property, you would usually use the equity in your home to pay for the deposit of the investment property, which means you don’t have to pay any upfront cash to purchase the property. This equity in your home can seldom be used for anything else, like investing into shares etc. Furthermore, purchasing a property means you receive the return on the entire property value instead of what you put in.

After 5 more years

At this point, they spend another 5 years doing what they were doing before – paying down debt and increasing equity. At 40, their financial position is as follows:

- Their mortgage has reduced from $900k down to $360k

- Their home value has increased from $1 million to $1.7 million

- $95k in each KiwiSaver

- $200k of equity in their owner occupied property

Their net financial position at 50 would be $5.15 million (including a $3 million home). They would have $2.15 million to retire if they’d like. They would do this by selling the investment property and moving the money into a managed fund so they can slowly erode the capital over time.

Important points

- While $5 million might seem impressive, remember that inflation erodes the purchasing power of money

- For simplicity, we have not taken any life events into account

- We’ve assumed a 5% capital growth rate

- Dan and Jen need to be able to service the negative cashflow of the investment property

For a no obligation discussion to see how we can help you on the path to wealth, please contact us.

Disclaimer:

The information in this article is general information only, is provided free of charge and does not constitute professional advice. We try to keep the information up to date. However, to the fullest extent permitted by law, we disclaim all warranties, express or implied, in relation to this article – including (without limitation) warranties as to accuracy, completeness and fitness for any particular purpose. Please seek independent advice before acting on any information in this article.